ILCU survey finds significant increase in students skipping lectures to work

Posted on: 19 Aug 2019

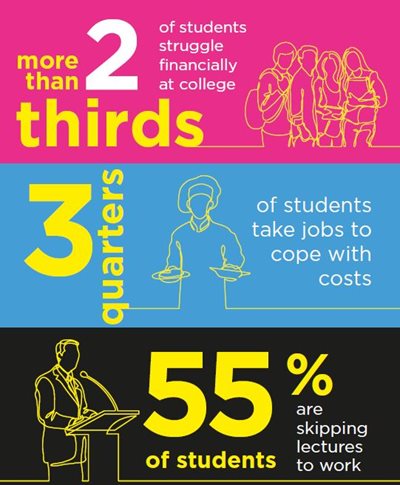

New, national ILCU research shows that more students are under financial pressure. A quarter (24%) say finance/debt is their biggest worry. Almost three quarters (74%) say they have to work during the college term to cope with costs.

The survey was carried out by iReach Insights in April 2019. 445 third level students were surveyed.

The survey was carried out by iReach Insights in April 2019. 445 third level students were surveyed.

Under Pressure to Work

The numbers saying they are skipping lectures in favour of earning money has risen substantially. 55% say they are missing their lectures in favour of paid work, up significantly on 22% in 2017. Six in ten say having to work has a negative impact on their studies during busier college times.

Of the three quarters saying they have to work to cope with costs, seven in ten are working part-time. 14% work full-time and 15% work ad-hoc hours. On average, students are working almost 15 hours a week (14.8 hours) and earning just over €10 an hour (€10.14).

Commenting on these findings, ILCU Head of Communications, Paul Bailey, said: “The realities of the impact of financial pressure on our third level students is apparent in this survey. It’s of concern to see that finance and debt is such a significant worry for so many students. At a time when they should be focusing on their education, it’s worrying to see that greater numbers are skipping lectures and sacrificing time spent on their education in order to earn some extra money.”

Mr Bailey continued “We know that some banks will entice students with freebies around this time to encourage them to become customers. However, banks won’t be there to provide one-to-one budgeting guidance should a student need it. They won’t be a friendly shoulder to lean on when the financial realities of third level hit - like your local credit union will. And should a student need to borrow to help them through college, the banks will not offer the same flexible repayment options as a credit union. Not to mention the not-for-profit and community ethos of credit unions which we know is of huge importance to students but which sadly is not so important to the banks.”

Third Level Costs

Students say their biggest monthly expense is, unsurprisingly, rent at an average of €318 a month. This is followed by food at €116. Students are spending €88 each month on travel costs and €74 on utility bills.

In the main, students will cut spending on social life (40%) and buying clothes (18%) to cope with costs. However, worryingly, 15% will cut down on buying food and 11% say medical check-ups will get the cut.

Financial Struggle

The majority of students (58%) say that financial or debt-related worries are having a negative impact on their experience at third level. Of these students, four in ten say they split their time between paid work and lectures and have no time for anything else. 22% say they have no money to do anything outside attending lectures. 18% say financial worries are a significant source of stress and are impacting on their mental health.

Looking at all students in the survey, well over two thirds (69%) say they struggle financially during the college term. Of these, more than a quarter (27%) say they find the costs a significant financial burden and struggle throughout the term. 42% say it is difficult financially, but they manage to get by.

The majority of those saying they find it difficult to manage would turn to parents or family for help if they were in real need of financial assistance (49%). 22% say they would turn to their local credit union. 12% said they would turn to their bank, with just 6% saying they would go to their third level institution or student’s union.

Over a third of all students surveyed (34%) said they expect that their third level education costs will leave them and/or their family in debt after graduation.

Unsurprisingly, the majority of students are in favour of abolishing third level fees (43%) and returning to state funded education. However, over a quarter (26%) say fees should be covered by the student and/or their families, but with a reduction in the current fees.

Lack of Financial Planning

Despite the fact that such a large portion of students struggle financially and say financial worries are having a negative impact, the vast majority admit to having no monthly budget. 57% said they didn’t have a financial plan or a budget to help manage third level costs.

Of these students with no financial plan, three in ten admit to needing one but say they just haven’t got around to it. 22% say they need a budget, but just don’t know where to start. 16% say that while they need a budget, they will never stick to it so there is no point.

44% say their third level institution does not provide assistance with financial or budgeting advice.

Overall, the majority of students (56%) say that the importance of budgeting or planning for third level was not adequately conveyed to them during secondary school.

Funding Third Level

The majority of students (42%) rely on parents and family to fund their third level education. 29% rely on the government grant and 13% on paid employment. Just 6% can fund their education from their savings.

Just over half of students say they receive a monthly allowance from their parents or family to help cover costs they incur. On average, they receive €202 per month. Almost half however (45%) say this is insufficient to cover their costs. Of those saying it’s not enough, a quarter say they would never ask for more money (26%). 19% however say they constantly have to ask for more money.