Junior Savers Week 2021: 5 Ways to Get Involved!

Community

3

min read

17 Sep 2021

This year, our favourite Junior Monster Bobbi is back in Credit Unions across the country for Junior Savers Week - and she's ready to share some handy savings tips and her very own saving story!

Credit Unions are running a number of initiatives throughout Junior Savers Week - the 20th-27th of September - to promote the habit of saving with younger members. Find out ways you can get involved, below:

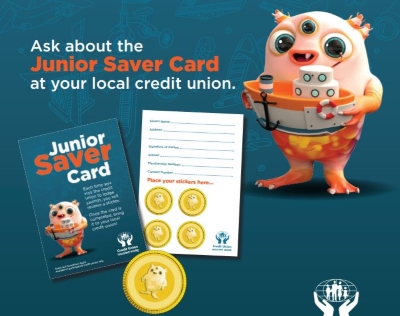

1. Pick up a Junior Savers Reward/Sticker Card

In participating credit unions around the country, you can pick up a Juniors Savers Sticker Card.

country, you can pick up a Juniors Savers Sticker Card.

Each time a young member saves, a sticker will be placed on their card. When they complete their card (when they save four or more times) in some credit unions they could recieve a reward or be entered into a draw.

T's&C's apply, and you can read more details about the reward/sticker card here.

2. Download our Fun, Financial Education Resources

The credit union have partnered with education company Twinkl Ireland to launch resources for children in primary school – these fun, interactive activities teach children of all ages about money.

education company Twinkl Ireland to launch resources for children in primary school – these fun, interactive activities teach children of all ages about money.

The resources, which are freely available for teachers and parents to download here from the Twinkl.ie, include topics like budgeting, spending and saving, earning money, impulse buying and investing.

Activities, which parents can download and do with their children at home, include shopping change, Reward chart pack, party budget activity sheets, Money saving challenges, and Start Money Smart board game, among others.

All NI packs can be found here, and ROI packs here. Links to each individual packs are below:

1. Junior-Senior / Foundation Stage

2. 1st-2nd / Key Stage One

3. 3rd-4th / Key Stage Two

4. 5th-6th / Key Stage Three

3. Read our Saving Tips from Real Parents

What is the best way to teach children about money? We spoke to parents about all the ways they help their children learn about money.

about money? We spoke to parents about all the ways they help their children learn about money.

Read advice from real parents, here.

Plus our article on the best financial advice for kids here.

4. Take our Fun Financial Edcuation Quiz

When were metal coins first used? What’s the difference between a want and a need? Get your children to test their know-how about money, and take our online 'Start Money Smart' financial literacy quiz!

The quiz questions are based on our Start Money Smart financial education resources - the 5th and 6th Class resources or Key Stage Three Carefully read through the Financial Education and the History of Money resources to find the answers to these quiz questions.

Read our Quiz terms and conditions here.

Play Now

5. Open a credit union account for your child

If you haven’t already, why not consider opening a credit union account for your little one, and kick start their savings journey? Find out why the credit union is the best place for your children to save, here.