January 2023 Consumer Sentiment Index NI | Published: 26/01/23

Northern Ireland consumers remain nervous as 2023 begins

-

Negative sentiment dominates particularly in relation to the ‘macro’ environment

-

Northern Ireland economy seen weakening further in year ahead

-

Unemployment also seen climbing but to a lesser extent than softening in activity

-

Household finances under pressure but 2023 not seen as widely negative as 2022

-

Consumers understandably cautious but not completely cancelling ‘big ticket’ spending

-

Special questions on five-year outlook suggest continuing economic strains but notably less negative consumer sentiment regarding personal finances and property prices.

Introduction and summary

This note sets out an analysis of the initial set of results for the Credit Union Consumer Sentiment survey for Northern Ireland. The survey fieldwork was undertaken by Core Research from January 4th to 17th. The independent analysis is conducted by the economist, Austin Hughes.

Not surprisingly, Northern Ireland consumers started 2023 in a nervous mood. On all key metrics, the Credit Union Consumer Sentiment Survey, shows negative responses significantly outnumbering positive responses. Yet, there are some modestly encouraging elements. Fewer consumers were negative in relation to the outlook for their household finances through the year ahead than was the case for the past twelve months and fewer again thought now was a bad time to make major household purchases.

On balance, the January reading for Northern Ireland was less downbeat than similar surveys for the UK as a whole but somewhat weaker than the comparable consumer sentiment reading for the Republic of Ireland. These comparative results appear consistent with materially different economic forecasts for the various areas as well as notably contrasting degrees of fiscal policy support at present.

Section 1; The mood of the Northern Ireland consumer at the start of 2023

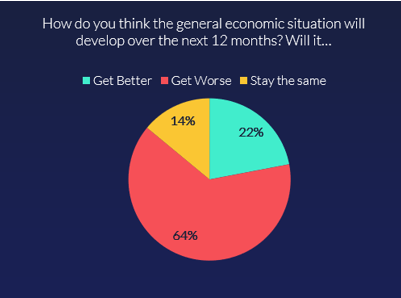

As the diagram below illustrates, two in three Northern Ireland consumers expect the general economic situation to weaken in the year ahead. Considering the overwhelmingly worrisome news flow around both global and local economic developments, this is not a surprising result. Arguably, a more notable finding is that just over one in five consumers sees scope for improvement in economic conditions in the next twelve months.

At the margin, those at both ends of the age spectrum tended towards more negative views as did those who reported difficulty making ends meet but overall, there was a broad consensus that 2023 is shaping up to be a difficult year for the Northern Ireland economy. Compared to similar surveys, Northern Ireland consumers appear to be notably less pessimistic than UK consumers as a whole but also somewhat more negative than their Republic of Ireland counterparts. These results seem entirely consistent with the broad thrust of economic commentary and numerical forecasts for activity in the various areas.

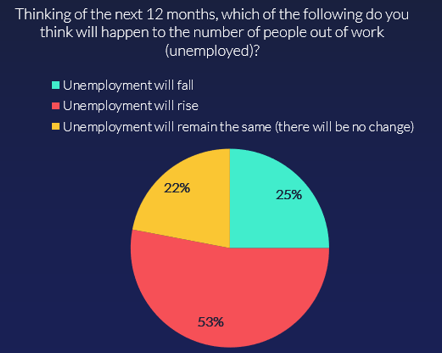

The Credit Union Consumer Sentiment survey, in partnership with Core Research, also asked Northern Ireland consumers how they felt unemployment would evolve over the next twelve months. The results illustrated in the diagram below show that the jobs market in Northern Ireland is expected to weaken. However, a comparison with expectations for economic activity might suggest that Northern Ireland consumers expect the jobs fallout to be relatively contained, perhaps hinting that they expect the degree of downturn may be limited.

Again, there was a generally negative view of the outlook for jobs across all demographics but notably more pessimistic responses were found among those at either end of the age spectrum (less than 25 years of age and over 55 years of age), among those with less education qualifications and among those currently struggling to make ends meet.

Consumer thinking in relation to the outlook for unemployment was broadly similar on both sides of the border but responses to the Republic of Ireland survey did not show the same age related variations that were evident in the Northern Ireland results.

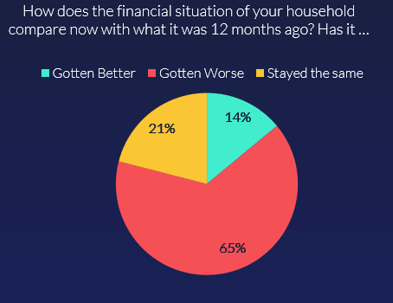

Northern Ireland consumers were also asked how their household finances now compared to those of twelve months ago. The responses, illustrated in the diagram below, appear to capture the widespread impact of cost-of-living pressures on consumers in Northern Ireland (and elsewhere).

Two out of every three consumers say their household financial circumstances have worsened in the past year. A small but not insignificant one in seven consumers report an improvement in their financial circumstances with these responses more common among younger and more highly educationally qualified consumers that likely reflects advances in employment and/or earnings on their part.

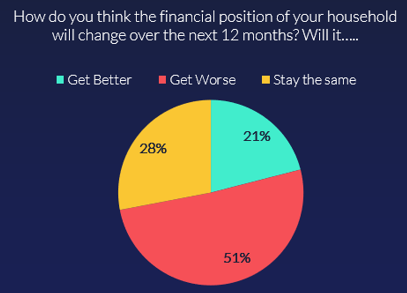

Northern Ireland consumers are understandably nervous about the prospects for their household finances through the year ahead. As the diagram below illustrates, roughly half of those surveyed expect their financial circumstances will worsen in the year ahead while just over one in four consumers expect an improvement in their household finances.

These results chime with the widespread expectation that while the rate of inflation may have peaked, it will remain elevated for some time to come, implying cost of living pressures will remain intense for many households. That said, the less negative balance overall in responses regarding household finances in the next twelve months compared to the past twelve months hints at least tentatively that some households feel they may now be past the worst. This improvement was more pronounced among younger consumers and those reporting a greater capacity to make ends meet at present.

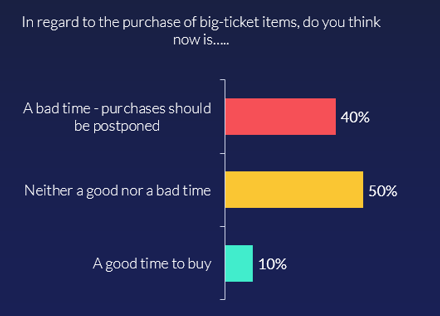

The final element of the Credit Union Consumer Sentiment Survey, in partnership with Core Research, for Northern Ireland attempts to assess the current buying climate by asking consumers if they think now is a good time to purchase ‘big ticket’ items such as furniture or large electrical goods. As the diagram below shows, Northern Ireland consumers are cautious in terms of making major financial outlays at present. This is to be expected in light of other elements of the survey.

Compared to similar surveys of UK consumers, the buying climate in Northern Ireland is modestly less negative, perhaps corresponding to the slightly less gloomy assessment of the general economic outlook. While the share of consumers who feel now is a good time to buy is not dissimilar in Northern Ireland and the Republic of Ireland, notably fewer consumers in the republic feel now current economic conditions make it a bad time to make large purchases.

Section II; What do Northern Ireland consumers think about their longer term economic and financial prospects?

It is envisaged that each reading of the Credit Union Northern Ireland Consumer Sentiment Survey will contain an additional ‘special’ question dealing with a topical issue. While there is a very strong sense that economic and financial conditions facing Northern Ireland consumers will remain very challenging in the near term, a key unknown is whether present difficulties will prove temporary or persistent features of the environment facing Northern Ireland consumers. As a result, the January 2023 sentiment survey contained a special question asking how Northern Ireland consumers envisage the economic and financial landscape will look in five years’ time.

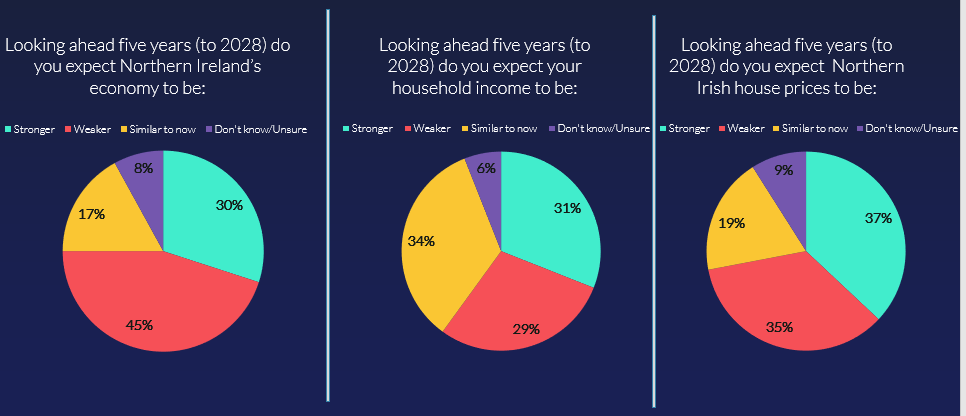

The responses given by Northern Ireland consumers to questions on the outlook for the general economy, their own household incomes and house prices are summarised in the diagram below.

As the diagram illustrates, negative sentiment continues to dominate in relation to the ‘macro’ outlook. However, concerns are less widespread than in relation to the twelve-month outlook; the balance between negative and positive responses is much closer at -15 percentage points on a five-year view than the -42 percentage point balance on a one year view. Encouragingly, views regarding the outlook for respondent’s own household finances move from a – 30 percentage point balance on a one-year view to a + 2 percentage point balance on a five-year view.

This result still suggests a significant three in ten Northern Ireland consumers expect a continued worsening in their living standards over the next five years, but it suggests sizeable numbers feel current pressures will begin to ease. In circumstances where- on balance-household incomes are seen increasing, it is not entirely surprising that house prices are also-on balance- seen increasing further.

In light of the exceptional nature of current cost-of-living pressures and economic challenges at home and abroad, it isn’t surprising that opinions are almost evenly split in regard to the outlook for household incomes and house prices. However, given the extent of near gloom, we would regard the five year ahead findings as a reasonably positive survey result.

About the Credit Union Northern Ireland Consumer Sentiment survey

Given difficulties in producing timely and meaningful official statistics, survey data have become an increasingly important indicator of economic and financial conditions worldwide. The Credit Union Consumer Sentiment Index for the Republic of Ireland is based on a data set that stretches back 27 years. Initially produced as a collaboration between Irish Intercontinental Bank (subsequently KBC Bank Ireland) and the Economic and Social Research Institute, the survey methodology is based on that used in one of the most reputable and longest-running US consumer surveys which has been produced by the University of Michigan since the mid-1940’s. That same methodology is being applied to the Northern Ireland survey.

The survey is based on the responses given by a representative sample of Northern Ireland Consumers to five key questions;

-

The general outlook for the economy in the next twelve months

-

The outlook for unemployment in the next twelve months

-

Household financial circumstances through the past twelve months

-

Expectations for household financial circumstances through the next twelve months

-

The current buying climate (is now a good or bad time to purchase ‘big-ticket’ items?)

The survey fieldwork is carried out by Core Research. The survey is internet-based and comprises a sample size of 350 (for comparison, the University of Michigan survey for the US aims at a sample size of around 600). The 350 sample size for the Credit Union Consumer Sentiment Survey for Northern Ireland implies a confidence interval of +or -5% at the 95% level.

The methodology and sample size allows the survey to produce a speedy and representative picture of the mood of Northern Ireland consumers and their assessment of the economic and financial environment they face. The January survey fieldwork was carried out between 4th and the 17th of January. It is envisaged that the survey will be carried out on a quarterly basis and the results released in the same calendar month in which it is taken. Each release will also carry a supplementary question on a topical issue.