May 2023 Consumer Sentiment Index | Published: 29/05/23

Irish consumer confidence improved further in May, hinting at a continuing easing in concerns about the economic outlook

- Consumer confidence at 14 month high in May 2023

- Contrast with weaker US sentiment hints at uplift from stronger Irish economy and buoyant Budget outlook

- Consumers still cautious on spending plans

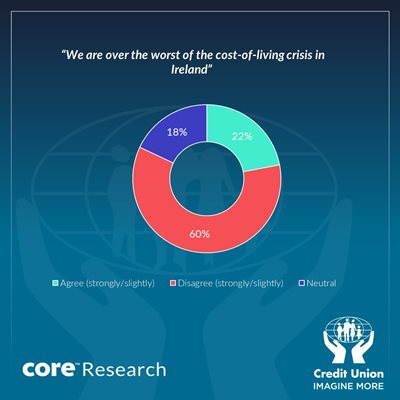

- Special question suggests 1 in 5 Irish consumers think worst of the cost-of-living-crisis is behind us but 3 in 5 disagree

- Majority of consumers planning to curtail spending in coming months, either

- To make ends meet

- To protect against further turmoil

- Or to make a special purchase

Irish consumer confidence improved further in May, hinting at a continuing easing in concerns about the economic outlook and, possibly, hopes for further Government measures to offer some respite from price pressures. Confidence is building slowly but surely, though current sentiment readings still signal fragile financial circumstances are weighing heavily on the mood of many Irish consumers.

The sense of continuing pressures is also reflected in responses to a special question asked alongside the May sentiment survey. These suggest that the majority of Irish consumers feel the worst of the cost-of-living crisis is not behind them at this point. In turn, very few consumers plan to increase their spending in the near term and most plan further cut-backs.

Section I; Stronger sentiment trend suggests fears slowly easing but household finances remain a problem

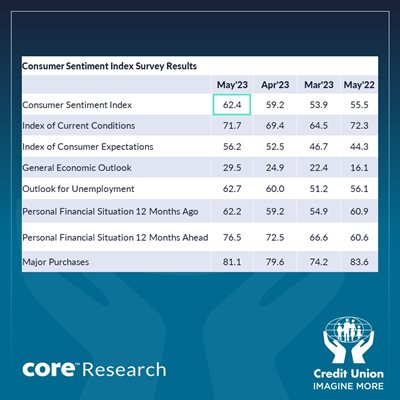

The Credit Union Consumer Sentiment Index (in partnership with Core Research) increased to 62.4 in May from 59.2 in April. The May reading is the strongest in 14 months and represents a marked improvement on the 14 year low-point of 42.1 recorded as recently as September of last year. So, a solidly improving trend appears to be well established at this point. However, the May 2023 reading still remains some distance below the 27 year series average of 86.5 and, as such, points to a still cautious mood on the part of Irish consumers.

The clear improvement in Irish consumer sentiment in May stands in contrast to a largely unchanged reading in the Euro area and a marked (and largely unexpected) decline in US consumer sentiment. A pick-up in UK consumer sentiment in May likely owes something to public holiday celebrations around the Coronation but might also reflect slightly less gloomy forecasts for the British economy of late.

The darkening mood of consumers in the US of late is being attributed to a sense that the American economy is set to weaken later this year. Another important factor being cited is repeated concerns around a possible debt default by the US Government. While it is generally thought that default will be avoided, recurrent problems around the stewardship of the US public finances appear to be taking a toll on US consumer thinking.

The particular problems worrying US consumers at present are instructive in that, most unusually of late, the element of the Credit Union Consumer Sentiment Index for Ireland that saw the biggest improvement in May was in relation to the general economic outlook. This month’s survey period saw a strong (and exceptional) upgrade of Irish economic forecasts by the European Commission and the Department of Finance.

While upgraded Irish economic growth projections contrast with a more downbeat outlook of late for the US economy, arguably a more important divergence in terms of consumer thinking relates to a markedly stronger outlook for the Irish public finances against a worsening budgetary position and process in the US. In turn, it might be inferred that Irish consumers are increasingly aware of much increased domestic ‘fiscal space’ highlighted by media reports referencing expected cumulative fiscal surpluses of €65 billion over the next four years.

Irish consumers remain scarred by the experience of the financial crisis of just over a decade ago, and this is reflected both in subdued sentiment readings and swollen savings rates at present. However, it would be surprising, given current cost-of-living pressures and deep-rooted problems in economic and social infrastructure, if Irish consumers took the view that merely squirreling away additional surpluses represents the optimal policy choice at a time of significant and varied economic strains. Future sentiment readings may provide further insights in this regard.

In circumstances where special questions in the May sentiment survey suggest most Irish consumers see cost-of-living pressures still firmly embedded, it may seem slightly surprising that the area of the Credit Union Consumer Sentiment Survey that saw the second biggest monthly improvement was in relation to the outlook for household finances. One explanation could be that an improving economic tide is seen lifting all boats, but it seems plausible that some consumers expect that one consequence of the fiscal windfall will be material additional support measures in the upcoming Budget ’24.

The other three elements of the Irish Consumer Sentiment Index also showed clear if modest month-on-month improvements in May. After a sharp gain in April, it is not entirely surprising that the jobs element of the survey saw a smaller uplift in May but, in circumstances where job announcements and official statistics continue to point towards a very strong jobs market, this remains a cornerstone of improving consumer confidence.

In recent months, consumers assessment of their household finances and their spending plans have shown a trend improvement but this has lagged the scale of gain seen in other elements. While economic fears have eased markedly, household finances remain under pressure and this is weighing on spending plans.

Is the survey message of a constrained uplift in consumer spending likely to be borne out? A recent article in the Economist magazine (27/04/23) cast some doubts on the relationship between trends in consumer spending and consumer confidence surveys globally. Historic data for Ireland show relatively close correlations between the Credit Union Consumer Sentiment Index and key Irish economic metrics such as consumer spending, employment and house prices through the first quarter century of the survey.

Inevitably, the exceptional circumstances of recent years, entailing a pandemic related shutdown of the economy and the nightmare of war in Europe, have impacted the mechanical monthly relationship between sentiment and spending. That said, the sentiment survey did caution against expectations of a post-Covid consumer boom, and this was borne out by official data showing that Irish consumer spending was only 1.9% higher in the 4th quarter of 2022 compared to the 4th quarter of 2019 (and there were 3.6% more Irish consumers due to population growth over that period).

Mindful of the caveat that monthly fluctuations in sentiment are unlikely to be mechanically mirrored in changes in household spending, it can still be argued that the trend changes in spending and Irish retail sales both point in a modestly positive direction of late-as the diagram below illustrates. The broader message of the Credit Union Consumer Sentiment Index for May is that a positive trend might be expected to continue in the months ahead, largely driven by improving employment and easing economic fears but consumers remain cash-constrained and cautious. So, any pick-up in spending may be modest and uneven.

Section II; Is the worst of the cost-of-living crisis over? Are Irish consumers likely to spend more or less in coming months?

As usual, the May Credit Union Consumer Sentiment Survey contained a couple of special questions. This month the questions focussed on whether the cost-of-living crisis was set to ease and whether consumers expected to step up their spending in coming months.

As mentioned in last month’s analysis, there has been a clear if modest easing in Irish inflation since the peak of 9.2% seen in October 2022 to the latest reading of 7.2% in April 2023 and it is widely expected that a further somewhat larger slowdown in inflation will continue through the remainder of this year and into next. However, in practical terms, this means that already elevated consumer prices will continue to rise at a fairly rapid clip for some time to come. There is very little sense that the previous surge in prices will reverse to any significant degree in the foreseeable future.

While the measured inflation rate may fall materially through 2023, cost-of-living pressures will continue to build for many but not for all consumers. Some consumers will see their incomes rise as fast or faster than the likely rise in consumer prices and others may be able to curtail their spending without any major adverse impact on living standards. Finally, it could be the case that some consumers take media commentary on falling inflation to mean prices might also fall. To get some sense of how well Irish consumers felt they might navigate price pressures in the current environment, the May sentiment survey asked whether consumers felt the worst of the cost-of-living crisis was now over. The responses are shown in the diagram below.

As the diagram indicates, consumers who feel the cost-of-living crisis has not yet peaked outnumber those who feel the worst is behind us by roughly three to one. Moreover, at 60% of those surveyed, a clear majority of Irish consumers do not think we have passed peak price pressures. That said, a non-negligible 22% of consumers believe the worst is over. Not surprisingly, these more positive responses tended to be more common among those who indicated they were making ends meet without difficulty and also increased among respondents with higher reported household income. The view that the worst of the cost-of-living crisis is behind us was also more frequently held by those aged under 35 and over 65, and by males rather than females.

Interestingly, a cross-tabulation found that those who believed the cost-of-living crisis is over were also markedly more optimistic in relation to their other survey responses both in relation to the general economic climate as well as their own household financial circumstances and spending plans. While the general tone of the sentiment survey might suggest the dominant role of financial strains and a fear factor, these results suggest distinct pockets where a feelgood factor is evident among a small but not insignificant group of Irish consumers.

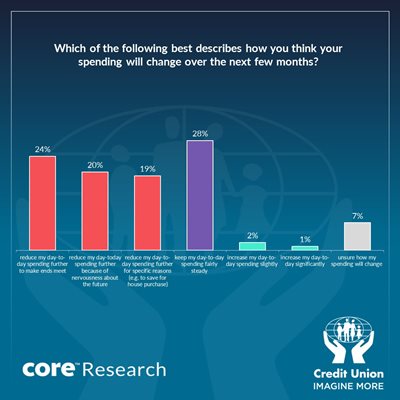

The May sentiment survey also asked consumers whether they expected their spending to increase or decrease in coming months. The responses shown in the diagram below suggest that very few consumers plan to step up their spending materially in coming months. Only 3% of consumers signalled any intention to increase spending while 28% of consumers say their spending will be largely unchanged.

These results suggest that the majority of Irish consumers-some 63% of those surveyed, envisage further reductions in their spending in coming months. The rationale for constrained spending varies markedly. The largest share, roughly one in four of all consumers (24% of survey participants) say that they will have to curtail spending to make ends meet. Alongside this group, a markedly different rationale is offered by a notable one in four consumers (20% of those surveyed) who are curtailing spending for a specific purpose that might for example include home purchase or improvements, buying a car or spending related to education. A further substantial one in four consumers (19% of those surveyed) say they will curtail spending because of nervousness about the future, suggesting that a ‘fear factor’ is still a strong influence on Irish consumer behaviour and an important driver of the continuing growth in household deposits. So, the survey suggests a diverse range of reasons for consumer spending to remain somewhat constrained in the months ahead.

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The survey was live between the 5th and 17th May 2023.