ILCU back to school survey shows cost of sending child to secondary school now averaging €1,500

Posted on: 15 Jul 2021

Annual ILCU back to school survey shows cost of sending child to secondary school now averaging €1,500

-

Parents now spending €1,491 per secondary school child – up €24 on last year

-

At primary school level, spending has increased by €63

-

Back to school costs still a challenge for parents with 63% of parents finding it a financial burden

-

A quarter of parents (24%) are getting into debt to cover the costs of back to school with 21% having debts over €500

-

The average debt parents find themselves in is €336

-

65% of parents believe that schools don’t do enough to help keep the costs of going back to school down

-

71% of schools still seeking a “voluntary contribution”

-

65% of parents say that that home-schooling and lockdowns had a negative effect on their child’s overall educational performance

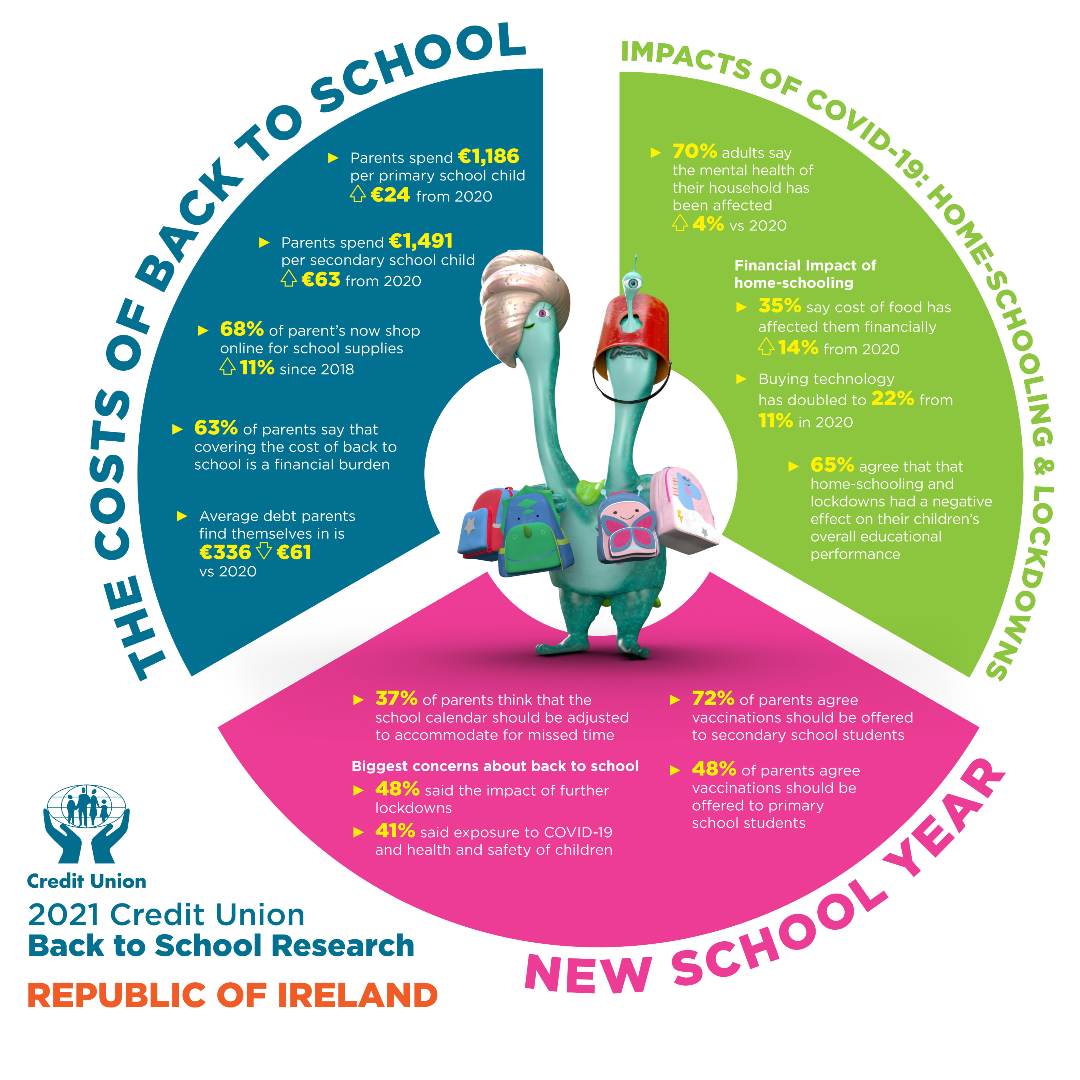

Despite the pandemic lockdowns and children being home schooled for the early part of the year, back to school spending is already on the minds of parents as they prepare for the new school year. The latest Irish League of Credit Unions (ILCU) survey on back to school costs shows the overall spend on school items is up for both primary and secondary schools. The cost of sending a child to primary school this coming year is just shy of €1,200 at €1,186, up €63 on last year, while parents of secondary school children can expect to pay an average of €1,491, up from €1,467 last year.

School books once again top the list this year as the most expensive item for parents of secondary school children at €211, up from €196 last year. Extracurricular activities are the top cost for primary school parents at €178, up from €167 last year. Spending on gym gear/sports equipment has increased for both primary school (€77, up €15 from 2020) and secondary school (€121, up €11 from 2020). Significantly, 43% of parents say they will have to deny their children new gym gear, a sharp increase of 16% from 2020. Parents also reported that 71% of schools are still seeking so called ‘voluntary contributions’.

Funding back to school continues to be a challenge for parents with 63% of parents saying that covering the cost of back to school is a financial burden. Nearly a quarter of respondents (24%) are getting into debt to cover the costs of back to school. Of these, three quarters have debts of over €200 with 21% having debts over €500. The average debt parents find themselves incurring is €336 which encouragingly is down €61 on last year’s figure.

Over two thirds (68%) of Irish parents said they use their monthly income to pay for back to school costs, followed by savings at 36%. Unsurprisingly, the number of parents using savings is up 2% from 2020, possibly due to reduced spending during the lockdown. Those relying on their credit card to pay for back to school costs is also slightly down at 17%, a reduction of 3%. However, the number of Dublin parents relying on their credit card for back to school purchases is worryingly high at 31%. A credit union loan is the preferred choice of 5% of parents, while 3% are still turning to moneylenders. 14% of parents rely on the state’s Back to School allowance, up 1% from last year.

This year’s survey also revealed that 68% of parent’s now shop online for school supplies, a rise of 2% from 2020, with respondent’s citing convenience (61%) as the main reason for doing so.

Impacts of COVID-19 – Home-schooling and Lockdowns

For the second year running, the ILCU survey also looked at the impact and concerns brought about by the COVID-19 pandemic.

COVID-19 has had a profound impact on families, with 7 in 10 adults surveyed reporting that the mental health of their household has been affected, and almost a third saying that their physical health has suffered.

As expected, households struggled with the challenges of home schooling with almost 1 in 3 parents saying they found it difficult to juggle home-schooling with work commitments and over a quarter agreeing that home-schooling was a burden.

1 in 3 parents (35%) said the extra cost of feeding children when home-schooling had the biggest effect on household finances. This was a noticeable increase (14%) from 2020. Over one fifth (22%) of parents reported that expenditure on laptops/tablets to support home-schooling has had an impact on their household finances compared to 11% in 2020.

65% of respondents agreed that that home-schooling and lockdowns had a negative effect on their children’s overall educational performance, and that their children were less focused on schoolwork.

One of the biggest impacts of home schooling and lockdowns, according to 88% of parents, was that children missed their friends and social activities. 60% also said that, despite this, children enjoyed being at home and spending more time with family.

New School Year

As a result of schools being closed for a number of weeks at the start of the year, 37% of parents think that the school calendar should be adjusted to accommodate for missed time. 31% of respondents believe that a focus should be put on children’s mental health when they return to school in September.

While a decision on the rollout of vaccinations to school children in Ireland is being considered by Government, the survey revealed that 72% of parents agree vaccinations should be offered to secondary school students with 48% in agreement for primary school students.

The biggest concern for parents about their children returning to school is the impact of a further lockdown (48%), while 41% are worried about exposure to COVID-19 and the health and safety of their children.

Commenting on this year’s findings, ILCU Head of Communications, Paul Bailey said “Since we began carrying out our back to school research over six years ago, we have seen a steady increase in the cost of school books and uniforms. It now costs a staggering €1,500 to send one child to secondary school, while the cost for a primary school child is not that much cheaper at nearly €1,200.

For parents with more than one school going child, these costs can place huge financial pressure on a family. Our survey shows that nearly a quarter of parents go into debt to pay for back to school costs with a fifth of these incurring debt of over €500. If parents are unable to pay for back to school from their household income or through their savings, I would encourage them to explore cheaper forms of finance, by talking to their local credit union or bank, rather than using a credit card or going to a moneylender.

For the second year in a row, we asked parents how COVID-19 had impacted their family life. One third of parents found home schooling and working a struggle, with over two thirds worried about the impact on their children’s overall educational performance. While many parents expect their children to return to school in September, they are concerned about the effect of further lockdowns and their child’s exposure to the COVID virus. Many households incurred extra costs as a result of home schooling such as buying more food and having to invest in laptops and tablets to support their children’s education. Again, I would encourage parents to talk to their local credit union to see how they can help”.

Ends