ILCU survey shows marked increase in average debt of parents coping with Back to School costs

Posted on: 12 Aug 2020

ROI Results

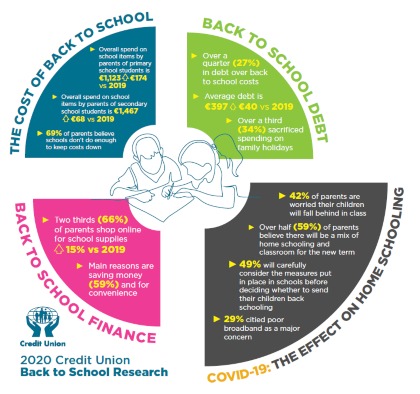

- Over a quarter (27%) of Irish parents find themselves in debt in order to cover the costs of back to school for their children, with 8% having debts of over €500

-

The average debt parents find themselves in to cover the costs of back to school is €397, an increase of €40 from last year

-

Parents now spending €1,467 per secondary school child – up €68 on last year

-

At primary school level, spending has increased by €174 and now stands at €1,123 per child.

-

69% of parents believe schools don’t do enough to keep costs down

Covid-19 related concerns

-

42% of parents are worried that their children will fall behind in class as a result of home schooling over the past few months.

-

Over half (59%) of parents believe there will be a mix of home schooling and classroom for the new term.

-

49% will carefully consider the measures put in place in schools before deciding whether to send their children back to school.

-

Over a third of parents said they are not equipped with sufficient resources if full or part-time home-schooling becomes the norm with 29% citing poor broadband as a major concern.

Media release 12th August 2020

Over a quarter (27%) of Irish parents are getting into debt to cover the costs of back to school. While this figure is down from 36% in 2019, the average debt parents find themselves in has increased by €40 from €357 to €397. Of this 27% in debt, over four fifths (81%) have debts of over €200 with over a quarter of these having debts of over €500.

This is not surprising as back to school costs continue to rise for parents, with the overall spend on school items for primary school students at €1,123, up €174 from last year. In secondary schools’ parents average spend is €1,467, up €68 on last year.

The top expense this year for parents of primary school children is after school care at an average of €200 up from €117 in 2019. For second level parents the biggest expense is books at €196 down from €220 last year. Voluntary contributions for primary schools have increased by 25% to an average of €110 per child from €88 in 2019, with secondary school contributions remaining at an average of €140.

Over two thirds (69%) of Irish parents pay for their children’s back to school supplies from their general monthly income with 20% using their credit card, up from 13% in 2019. The use of savings has grown from 27% to 34%, 6% take a credit union loan, down from 9%, with those turning to moneylenders remaining at 3%.

66% of parents say that covering the cost of back to school is a financial burden, although encouragingly this is down from 78% last year. Almost 4 in 10 (37%) consider the costs associated with back to school as their main concern in the lead up to getting their children ready to return to school, down from 50% in 2019. Interestingly, there has been an increase in parents being concerned amount managing their schedule at 33% up from 20% last year.

The findings were revealed in the annual Republic of Ireland school-costs survey commissioned by the Irish League of Credit Unions (ILCU) and carried out by i-Reach Insights in June 2020 when 948 parents of school going children were surveyed.

The results of the survey also revealed that 66% of parents shop online for school supplies, a rise of 15% from 2019, with respondents citing convenience (59%), saving money (59%) and the availability of better deals (56%) as the main reasons for doing so.

Cutting back on family holidays is still one of the biggest sacrifices that families make to cover back to school costs at 34%, with a quarter cutting back on summer camps. 64% have had to deny their children extracurricular activities with 38% cancelling school trips to help fund back to schools costs.

44% of parents say they feel pressured into buying branded clothing, footwear and other items for their children as opposed to generic or own brand goods, while more than 2 in 3 (69%) believe that schools don’t do enough to help parents keep the costs of going back to school down, an increase of 5% from 2019.

COVID-19 findings

The ILCU survey also highlighted concerns of parents brought about by the COVID-19 pandemic.

Over a fifth (22%) of Irish parents reported that there has been a reduction in their household income as a result of Covid-19. A similar number (21%) are finding the extra cost of feeding their children when home-schooling to have had the biggest effect on household finances.

When it comes to children going back to school, 59% of parents believe there will be a mix of home schooling and classroom for the new term while nearly half (49%) said that they would carefully consider the measures put in place in schools before deciding whether to send their children back to school.

42% of parents are worried about their child’s mental health for the upcoming term if children will not be returning to school in a full-time classroom setting with a further 41% concerned about their children catching up on missed teaching. 42% of parents are already concerned that their children have fallen behind in class as a result of home-schooling during the lockdown, while 23% said they would struggle with returning to work if schools don’t reopen fully.

Since the beginning of the COVID-19 lockdown, 36% of parents feel their children are spending too much time watching TV or on mobile devices (32%) as a result of being home-schooled. A third of parents (33%) also believe their children are missing their friends from school and may be lonely as a result.

If schools do not reopen or only partially reopen, 38% of parents stated that they are lacking resources for proper home schooling. These include educational resources and materials (38%) and printing (35%). Nearly a third of respondents cited poor broadband coverage as a major concern in delivering effective home schooling.

Commenting on this year’s findings,

Paul Bailey, ILCU Head of Communications said;

“Of concern from the survey results is the amount of debt that parents are getting into to cover back to school costs with an average debt increase of €40 compared to last year. While the majority of parents fund back to school purchases from their general household income, the use of credit cards has increased from last year. I would encourage these parents to explore cheaper forms of finance such as a credit union loan.

The overall spend is up again this year for both primary and secondary school and it is clear that parents continually have to make sacrifices to cover costs. We have seen a staggering 71% increase, from €117 to €200, in the cost of after school care for primary school children while so called ‘voluntary’ contributions have increased by 25% to an average of €120 per child.

It remains to be seen if schools will reopen fully in September and this brings a number of challenges for parents in trying to manage home schooling and to balance work and child care commitments.

Our survey shows a substantial number of parents are concerned that they don’t have the necessary resources for home schooling, including adequate broadband, in the event of schools remaining fully or partially closed. I would encourage any parent concerned about the costs of home schooling or back to school costs to contact their local credit union to see how they can help.”

Ends

Northern Ireland Findings

-

32% of parents find themselves going into debt to cover the costs of back to school with an average debt of £222, up £30 since 2019.

-

Primary school spend increases by £132, while secondary school spend drops by £29

-

54% of parents say that covering the cost of back to school is a financial burden

-

The largest expense for both primary and secondary school parents was uniforms

-

‘Voluntary’ contributions on average cost parents £120 per child, an alarming increase of 46% on 2019 figures with secondary school parents contributing £132.

Covid-19 related concerns

-

42% of parents are now worried that their children will fall behind in class.

-

Over half (59%) of parents believe there will be a mix of home schooling and classroom for the new term.

-

Almost a third of parents said they are not equipped with sufficient resources if full or part-time home-schooling becomes the norm including educational material, printing and technology supports.

Just under a third (32%) of Northern Ireland parents are getting themselves into debt to cover the costs of back to school. While this figure is down from 37% in 2019, the average debt parents find themselves in has increased from £192 to £222. Of the 32% in debt, nearly half (46%) have debts of over £200 as a result of back to school costs.

54% of parents say that covering the cost of back to school is a financial burden, although encouragingly, this is a decrease from 72% last year. Almost 4 in 10 (38%) consider the costs associated with back to school as their main concern in the lead up to getting their children ready to return to school, a significant drop from 48% in 2019.

Almost three quarters (74%) of Northern Ireland parents pay for their children’s back to school supplies from their monthly income with 21% using their credit card and 13% drawing on their savings. 2% of parents turn to a doorstep lender or payday loan company which is similar to last year.

The overall spend on school items in primary school is £908, up £132 or 17% on last year. The top expense this year for primary school was uniforms at £131, an increase of £22 from 2019.

In secondary schools, parents spend is £1,038 on average, down from £1,067 in 2019, with uniforms also topping the list at £177 (up £8) followed by school lunches at £137.

Voluntary contributions have increased by 46% to £120 on average per child with parents of secondary school children being asked to pay £132. Afterschool care in secondary schools has also increased to £76, up £14 on 2019.

The findings were revealed in the annual Northern Ireland school-costs survey commissioned by the Irish League of Credit Unions (ILCU) and carried out by i-Reach Insights in June 2020.

The results of the survey also revealed that 62% of parents shop online for school supplies, down from 75% in 2019, and stated that the main attraction to buying online is for better deals (62%) and to save money (55%). Another 55% believe that schools don’t do enough to help parents keep the costs associated with back to school down.

Cutting back on family holidays is still one of the biggest sacrifices that families make to cover back to school costs at 23% but this is significantly down from 39% last year. 44% have cut back on extracurricular activities with 36% denying their children new shoes.

COVID-19 findings

The ILCU survey also highlighted concerns of parents brought about by the COVID-19 pandemic.

A third of Northern Ireland parents reported that there has been a reduction in their household income as a result of Covid-19. 1 in 4 (25%) of respondents in NI are finding the extra cost of feeding their children when home-schooling to have had the biggest effect on household finances.

When it comes to children going back to school, 64% of parents believe there will be a mix of home schooling and classroom for the new term while 51% said that they would carefully consider the measures put in place in schools before deciding whether to send their children back to school.

45% of parents are worried that their children have fallen behind in class as a result of home-schooling and parents acknowledge their children are spending too much screen time watching with TV (38%), mobile devices (28%) and laptop/games being the devices of most concern for parents.

If schools do not fully reopen in September, half of Northern Ireland parents stated their biggest concern would be for their children catching up on lost teaching, while 48% said they would be worried for their child’s mental health. A further 27% of parents said they would struggle with returning to work if schools don’t reopen fully.

Ends

For interview requests with Paul Bailey please contact Aoife Breathnach at abreathnach@creditunion.ie or on 087 350 4810

Notes to Editors

-

The Irish League of Credit Unions is the largest representative body for credit unions on the island of Ireland and represents 217 credit unions in the Republic of Ireland.

-

This survey was carried out by iReach Insights on behalf of the Irish League of Credit Unions between 14th and 23rd June 2020.

-

iReach uses proprietary research panels across consumer and business groups, built on a nationally representative model