Irish consumers remain concerned and cash-strapped

Posted on: 24 Mar 2023

-

Continuing cost-of living pressures and increased global uncertainty make Irish consumers more cautious in March.

-

Slight decline in sentiment reading suggests no dramatic change in mood of consumers but emphasises that major pressures on household finances persist

-

Spending plans weaken as global backdrop becomes more threatening.

-

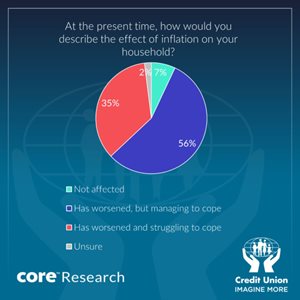

Special questions suggest only 7% of consumers not feeling the effects of higher inflation while 35% say they are struggling.

-

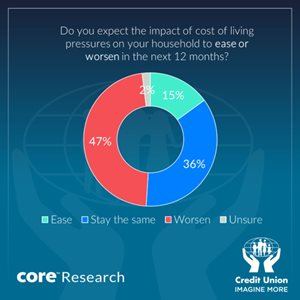

15% of consumers say cost of living pressures on their households should ease in next 12 months but 47% expect it to worsen.

Section I; Weaker confidence reading for March reminds us that problems are not melting away.

Irish consumer sentiment slipped back marginally in March as continuing cost of living pressures, further tech sector woes and ongoing problems in the Irish housing market made consumers somewhat more nervous about their financial circumstances and caused them to scale back their spending plans.

In circumstances where negative financial news-flow dominated the survey period by quite a margin, the drop in consumer sentiment this month could probably be regarded as relatively modest. Moreover, given the improving trend in recent months in still difficult and uncertain conditions, a correction lower in consumer confidence is not at all surprising. It is also worth noting that the fall in the Irish sentiment measure was smaller than that seen in the comparable US indicator in March.

The small pull-back in Irish consumer sentiment in March is only the second in the past six months and, as such, should probably be seen as signalling that consumers are still very much aware of the substantial financial headwinds that they face in early 2023 rather than pointing to a marked darkening in the mood in Irish households of late. However, recent global financial turbulence, allied to persistent inflationary pressures, suggests sentiment could remain subdued and might even appear more strained in the months ahead.

The Credit Union Consumer Sentiment Index (in partnership with Core Research) slipped to 53.9 in March, its weakest reading of the year to date, albeit only modestly lower than the 55.6 reading for February. It was also the first month-on-month drop since last November.

The general sense of a more nervous Irish consumer is underlined by markedly more negative than positive responses to all the key elements of the survey. As such, it suggests a clear ‘feel-bad’ factor on the part of Irish consumers.

However, as the diagram above also illustrates, the March reading is also materially stronger than those seen last autumn or at previous survey troughs during the financial crisis or the pandemic. In that sense, it suggests Irish consumers remain conscious of the resilience of the Irish economy and are likely also aware of the significant fiscal capacity that exists to at least partly offset financial strains facing households.

As the table above sets out, three of the five components of the Credit Union Consumer Sentiment Index declined in March while two improved. In all cases, the monthly swings were relatively modest suggesting no dramatic change in consumer thinking of late and, in each instance, the change in March still left more negative than positive responses to all of the five components of the sentiment index.

There was a slight upgrade of consumer thinking on the Irish economic outlook possibly stemming from continuing upgrades of economic forecasts coupled with buoyant tax returns. In contrast, expectations for the job market weakened slightly that may be in response to a further sequence of layoff announcements in the tech sector.

Encouragingly, consumers were a little less negative about the outlook for their household finances in the year ahead. This likely reflects a continuing material easing in global energy costs and, perhaps, some impact from the Government’s latest Cost-of-living package announced during the survey period.

That said, the still overwhelmingly negative tone of this part of the survey emphasises that Irish consumers remain strongly of the view that their household finances will weaken further in the next twelve months.

Consumer views on how their financial circumstances have changed in the past twelve months and their spending plans were the most negative elements of the March sentiment report, with both showing a clear deterioration compared to the February survey.

The downgrade of current household finances likely owes something to a continuing acceleration in grocery price inflation and worrisome trends in mortgage and rental costs as well as media reports suggesting that firms boosting profit margins represented an additional source of upward pressure on prices.

In turn, continuing pressure on household finances coupled with increasing uncertainty about the global economic and financial outlook led consumers to downgrade their assessment of the buying climate further.

While this barometer of spending plans is still somewhat more positive than the series low-point seen during Covid-19, it is now running at levels consistent with a very subdued tone in consumer spending. As such, it points to a potentially difficult period for many consumer-facing businesses in the months ahead.

Section II; How are consumers coping with cost-of-living pressures? Are they overstating their difficulties?

Judging how strong the impact of higher inflation is on the financial circumstances of Irish consumers is not entirely straightforward. Anecdotal evidence differs sharply and your perception of the current condition of the Irish consumer is likely to vary quite considerably if you take the pulse from a stroll through a country town at midweek or from Dublin city centre at the weekend.

According to National Accounts data, Irish consumer spending increased by 6.6% in ‘real’ or inflation-adjusted terms in 2022, the largest increase since 2007. However, this largely reflects a rebound from the Covid-distorted outturns that saw a sharp drop in spending in 2020 (-10.9%), followed by a partial recovery in 2021 (+4.6%). As a result, the level of consumer spending in the 4th quarter of 2022 was only fractionally higher than the level seen in early 2019. So, depending on how you assault the official data, the case could be made for consumer boom or consumer gloom in Ireland of late.

The Credit Union Consumer sentiment survey for March included a special question intended to assess how widespread and how severe cost of living strains are at present across the widely varying financial circumstances of Irish consumers.

The results shown in the table above suggest, perhaps not surprisingly, that the impact of cost-of-living pressures is being felt by the vast bulk of Irish households. Only 7% of consumers suggested they were not experiencing any notable effect from higher inflation. However, this would amount to a not insignificant 250-300k adults who say they are largely immune to inflation-related difficulties at present.

As might be expected, those reporting no impact from higher inflation were concentrated among those on higher incomes and those who reported no difficulty making ends meet. Over 65’s were also somewhat more likely to report no impact than other age groups-a response that hints at widely different financial circumstances within this cohort. We might speculate that, at one extreme, some of these older consumers are always struggling to cope with fixed and limited spending power while, at the other end of the spectrum, some older consumers may be finding their finances are more than adequate to deal with reduced spending commitments.

An altogether larger proportion-some 56% of Irish consumers say that while inflation has caused a worsening in their financial circumstances, they are managing to cope. This group is roughly split into those who report their circumstances as having worsened substantially and those who see a lesser change and say their circumstances have changed somewhat. However, in both cases, these consumers seem to have some financial capacity to handle the increase in their living costs.

A further substantial 35% of consumers say they are struggling to cope with the impact of inflation on their household finances. Slightly less than half of the consumers in this group (15% of those surveyed) say higher inflation has had a substantial impact on their household finances while the remainder (20% of all consumers) reported a smaller impact. However, the latter group may have had a more precarious financial position and even a modest change in their circumstances may have been sufficient to markedly alter the sustainability of their position.

A sometimes-underappreciated implication of these responses is the range of variation in impacts on individual consumers from a common problem or shock. A small segment of Irish consumers appear to be seeing no major impact and to, borrow a quote, ‘while all happy families are alike, each unhappy family is unhappy in its own way.’ This could reflect any number of household specific factors influencing disposable income or spending commitments.

As a result, although a ‘hierarchy’ of difficulty in dealing with inflation may be correlated with income and life-cycle characteristics, the range of responses within similar ‘profiles’ emphasises the difficulty in establishing definitively who may be having severe problems and, accordingly, where cut-off points in access to targeted policy responses should begin and end.

It should also be noted that the overwhelmingly widespread reports of difficulties in dealing with cost-of-living pressures might seem to sit a little uneasily with CSO data that suggest that in aggregate Irish household incomes increased faster than the rise in consumer prices in 2022. However, population growth meant the number of households rose significantly, implying in very broad terms that the average Irish consumer was worse off in 2022.

A second and possibly important issue could be that the spread of income gains was very uneven, meaning that many households did experience a material drop in living standards last year. Finally, the exceptional range of difficulties and notably increased uncertainty may have consumers to err on the side of negativity in reporting their current circumstances.

The March Credit Union Consumer Sentiment Survey asked a second supplementary question probing whether consumers expect cost of living pressures to worsen or ease in the next twelve months. The responses shown in the table below suggest few consumers expect any material improvement in their cost-of-living difficulties in the next twelve months.

Only 15% of Irish consumers expect an easing in cost-of-living pressures on their household in the coming year. As might be expected, these responses were more common among those on higher incomes and those who reported no difficulty in making ends meet at present. Interestingly, those aged under 35 were also comparatively optimistic in this regard. While we have no strong sense of why this might be the case, it could owe something to the impact of a still strong jobs market on employment and earnings prospects.

While 36% of consumers expect cost of living pressure on their households to remain as they are at present, the most common expectation -held by 47% of Irish consumers, is that cost of living pressures will worsen for their own households.

In circumstances where most analysts are suggesting inflation and Ireland will fall significantly in 2023, it is worthwhile considering why consumers may hold largely negative views in regard to the cost of living.

In this context, it is worth noting that while there is a strong consensus among professional forecasters that the rate of inflation will ease as 2023 progresses, there is no expectation that consumer prices will fall.

So, the cost of living will increase further and unless incomes rise faster than prices in the year ahead, cost of living pressures will worsen. For this reason, the broad judgement of consumers that cost-of-living pressures are far more likely to worsen than ease seems justifiable.

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The survey was live between the 3rd and 20th March 2023.