Majority of Credit Card Users Unaware of What Interest Rate They Pay

Posted on: 31 Jan 2020

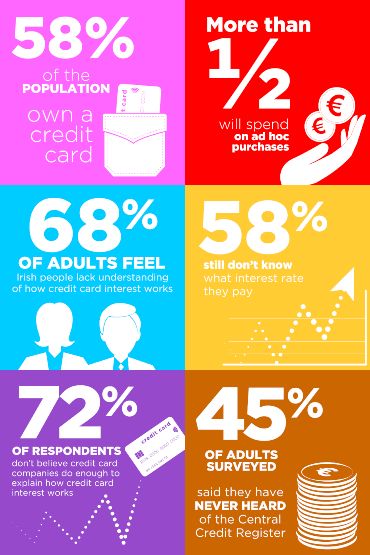

Over half of Irish credit card holders (58%) don’t know what interest rate they are paying.

A national survey issued by the Irish League of Credit Unions (ILCU), looked at credit card usage spending habits. Since a similar survey was published last year, there has been no improvement in public awareness of interest rates or spending habits. Over half the Irish population (58%) own a credit card with the majority spending it on adhoc items. Despite this, many are still confused about the rate of interest they are paying.

Of those who said they were aware of the rate they pay, over half believe they are paying less than 10%. In reality credit card interest typically ranges from between 13% to 23% in the Irish market.*

Over two thirds of the population (72%) believe credit card companies in Ireland don’t do enough to explain how these rates work while 70% say Irish consumers are too reliant on this method of lending.

Interest Rates

The majority (58%) credit card holders don’t know what interest rate they pay and almost 40% are unsure how that rate is applied. Of those that state they are familiar with their credit card interest rate:

-

One quarter think they pay less than 5% in interest.

-

One fifth think they only pay between 6% and 10%.

-

28% think they pay between 11% and 17%.

-

27% think they pay 18% to 24%.

In reality, credit card interest typically ranges from between 13% to 23% in the Irish market.**

Of those who claimed to know what rate they paid, there was confusion around how that rate was applied. 36% of credit card holders incorrectly state they “don’t pay any interest” if they cover the minimum balance due at the end of each month. The same amount, (36%) correctly state they pay interest on the full balance as well as interest on the outstanding balance from the date of the transaction.

Spending Habits

Over half the population (58%) own a credit card and more than half will use it to buy ad hoc items. 16% will spend it on a holiday while just 11% made a New Year resolution to throw the card away.

A significant 70% of credit card holders plan to use their monthly income to clear their balance fully every month. 63% of adults state that they have never missed a loan or credit card repayment giving them a perfect credit rating.

Attitudes

70% of adults agree that people in Ireland rely too much on credit cards for making purchases while 43% believe people are spending the same, or more on their credit cards.

68% are convinced that the general public lacks an understanding of how credit card interest works. 72% of respondents believe credit card companies in Ireland don’t do enough to explain how credit card interest works, whereas nearly a quarter or 24%* feel that users spend less on their credit cards than before

Central Credit Register

45% of adults surveyed said they have never heard of the Central Credit Register*** - 6% more than last year. A further 24% having some awareness but not sure of its role.

39% won’t change their behaviour towards loan repayments after hearing about the CCR, basing their confidence on past ability to meet repayments. 20% will try to be more diligent in making repayments on time.

Commenting on the findings, ILCU Head of Communications, Paul Bailey said:

“Since issuing a similar survey last year, there has been a notable lack of improvement in consumer awareness around credit card interest and how that interest is applied. With a significant number of people in the country still using credit cards to fund ad hoc items, it is concerning that lack of knowledge on interest rates remains very much widespread.”

“Many people believe credit card companies aren’t doing enough to explain how interest rates work. There are other places that encourage consumers to use resources such as The Competition and Consumer Protection Commission website, which provides simple explanations on financial products. At the credit union, we like to provide an open environment that provides guidance and support to anybody with these types of queries.”

“On a positive note - there has been an increase in the number of people who are aware of the Central Credit Register and with a fifth saying they would try be better at making payments on time, so we hope to see more optimistic changes in 2020.”