NI consumer sentiment notably stronger but still cautious

Posted on: 26 Apr 2023

Section I; Consumer confidence still subdued but notably stronger now than in January

It is not surprising that Northern Ireland consumers are concerned regarding the general economic outlook and their own household finances. However, the most notable aspect of the Northern Ireland Credit Union Consumer Sentiment Survey (NICUCSS) for April is that recent months have seen a marked easing in negativity in relation to the economic and financial conditions.

Compared to the initial survey reading taken in January, there has been a significant improvement in all five key elements of the April reading. The shift was primarily due to a clear decline in negative responses, accompanied by notably more modest increases in positive responses.

We would interpret the combination of responses as indicating that Northern Ireland consumers feel economic and financial conditions have not deteriorated nearly as much as previously feared, rather than any pointer that markedly more favourable conditions have taken hold of late.

It remains the case that many Northern Irish consumers face serious cost-of-living pressures and/or an uncertain economic future. However, the April Credit Union Consumer Sentiment Survey points to a significant decline in negativity that could provide a platform for stronger activity to build.

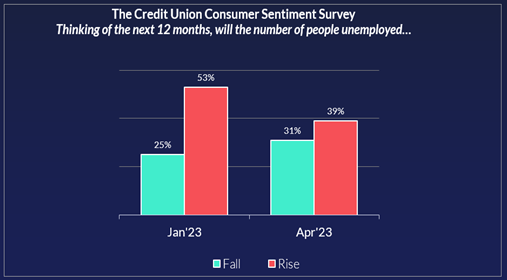

As the diagram below illustrates, the most notable improvement in the Credit Union Consumer Sentiment Survey between January and April was in relation to the outlook for jobs. In part, this reflects a recent step-back from some of the more downbeat predictions for the key economies of importance to Northern Ireland.

In addition, the softer trend in global and local economic conditions through the past year has been less job-destructive than feared, and it seems that Northern Ireland consumers are aware of a far healthier outlook for employment than they previously expected.

Finally, it may be that some of the positivity in relation to the potential for the Northern Ireland economy emerging from the Windsor Framework agreement as well as discussions marking the anniversary of the Good Friday Agreement may have encouraged improved sentiment in relation to the outlook for jobs.

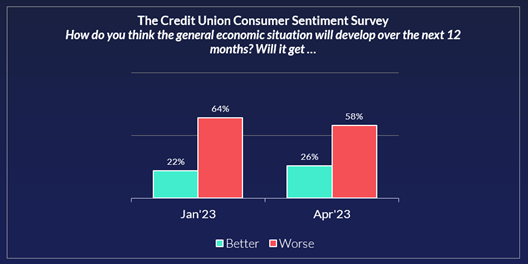

There was a markedly smaller improvement in sentiment in the past three months in relation to the general economic outlook, as the diagram below shows. Although it should be emphasised that this element has moved in a positive direction of late, the gain was likely tempered by ongoing uncertainty about global economic developments as well as the continuing absence of the Northern Ireland assembly and recent warnings about the prospect of major local budget cutbacks.

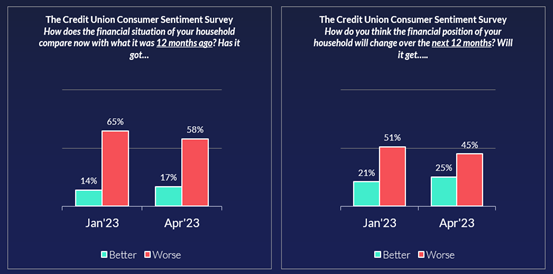

The Northern Ireland Credit Union Consumer Sentiment Survey suggests there has been a significant improvement in consumer thinking regarding their own household finances in the past three months. The April survey shows broadly similar upgrades in relation to developments through the past twelve months and expectations for the next twelve months. Again, as the diagram below illustrates, these gains were primarily due to a decline in negative responses but there were also marginal gains in numbers reporting improvements in their household finances.

It should also be noted that there was a small but significant difference between the backward and forward-looking elements that hints that Northern Irish consumers may feel that while conditions are likely to remain tough through the next year, the worst of the pressure on their household finances might now be behind them.

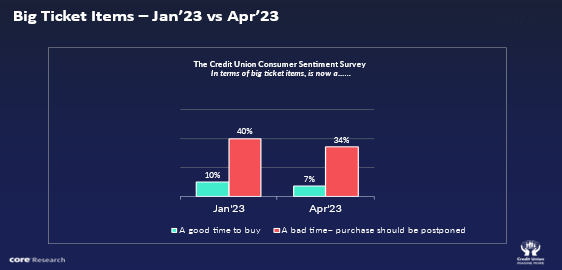

While the general tone of the April Norther Ireland Consumer Sentiment Survey is much improved compared to January, it is still signalling a difficult economic and financial environment for most consumers. As a result, it is not entirely surprising that consumers remain extremely cautious in their spending plans as the diagram below suggests.

Responses to the question on the buying climate for big-ticket purchases saw the smallest improvement of the five survey elements through the past three months. While the broad survey message is that an improvement in the mood of consumers is clearly underway, many consumers are neither able nor willing to translate that into a jump in their spending as yet. So, the sentiment survey suggests any pick-up in spending could be solid or even slow rather than spectacular.

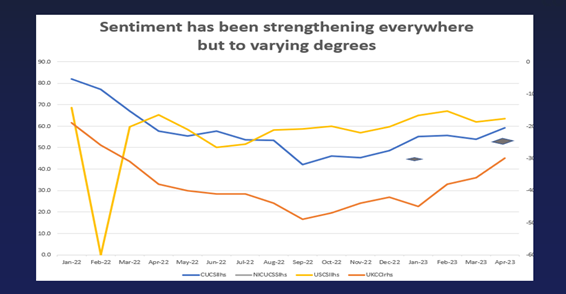

Recent months have seen improvements in consumer sentiment surveys for most economies. In part, this reflects the widespread effects of a fall in global energy prices and the related impact of a relatively mild winter that curbed the use of expensive heating. In addition, forecasts for the global economy, while still relatively downbeat, have seen a couple of upgrades in recent months.

While there has been a generalised improvement in the mood of consumer globally of late, the degree of change in household thinking has varied widely. Our judgement is that the improvement in Northern Ireland consumer sentiment in recent months has been comparatively strong.

With just two readings of the Credit Union Consumer Sentiment Survey thus far, it is not possible to construct a survey index as yet. However, for illustrative purposes only, we fed the results of the Northern Ireland survey for January and April into the settings for the Credit Union Consumer Sentiment Survey for the Republic of Ireland to get a sense of Northern Ireland Consumer Sentiment in a comparative context. The results shown in the diagram below give a flavour of what we would describe as a strong improvement but to a still subdued level of consumer sentiment in Northern Ireland of late.

Section II; Would a financial emergency spell a minor difficulty or a major disaster for consumers in Northern Ireland?

The April 2022 Credit Union Northern Ireland Consumer Sentiment Survey included an additional question focussed on households’ capacity to weather a financial emergency. This is based on a similar question asked in the regular ‘Report on the Economic Well-Being of U.S. households’ conducted each year by the US Federal Reserve.

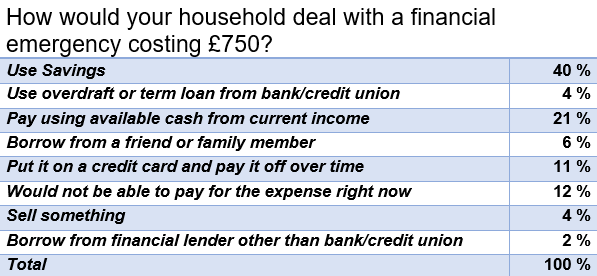

The responses given by Northern Irish consumers to the question ‘How would your household deal with an unexpected financial emergency costing 750? in the April 2023 sentiment survey are shown in the diagram below.

We would interpret these results as suggesting that three in five Northern Irish consumers could handle a financial emergency reasonably comfortably-either from current income or by drawing down savings (21%+40%). About one in seven consumers (15% of those surveyed) would deal with such a difficulty by borrowing from a bank or credit union through a loan or credit card debt. A further one in ten would borrow from family or friends or would sell something. However, as many as one in eight (12%) of Northern Irish consumers say would be unable to deal with an unexpected financial difficulty at present.

Considering the strains posed by rapidly increasing consumer prices through the past year, it is not surprising that a significant number of Northern Irish consumers say they have no capacity to handle a financial emergency at present.

Again, not surprisingly, these responses were concentrated among consumers who also stated they were making ends meet with difficulty at present. These responses also became notably less frequent among those with higher incomes. There was a notably higher incidence of this response among those aged 35-44, perhaps reflecting greater family spending commitments among this age group. In the same vein, almost twice as many females surveyed gave this response, hinting at significant gender-based differences in financial capacity.

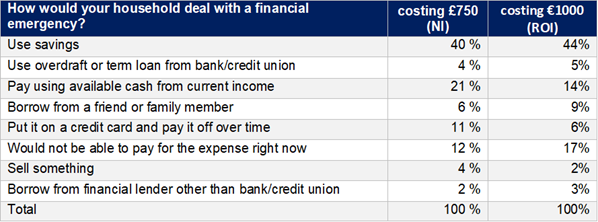

Some context on these results may be provided through a comparison with responses to a similar question in the April 2023 Credit Union Consumer Sentiment survey for the Republic of Ireland (The most recent comparable data for the US are for March 2022). The amounts involved are slightly different, but account needs to be taken of higher average household incomes in the Republic of Ireland.

As the table below illustrates, the share of consumers who would use either savings or current income, and therefore could be described as capable of coping reasonably comfortably with a financial emergency is broadly similar in the two surveys. However, the proportion of consumers in the Republic who say they couldn’t deal with a financial emergency is clearly higher than in Northern Ireland, with an offsetting difference in those likely to put it on credit card.

The Northern Ireland Credit Union Consumer Sentiment Survey is a monthly survey of a representative sample of 350 adults. Core Research undertake the survey administration and data collection for the survey. The survey was live between the 3rd and 20th April 2023