Irish consumer confidence slightly down in February as living cost pressures and layoff threats sugg

Posted on: 26 Feb 2024

February sentiment fall reverses about a third of January’s gains

-

Trend in Irish consumer confidence still encouraging but easing in inflation unlikely to be sufficient to spark widespread ‘feel-good’

-

Tech cutback fears and domestic redundancy news prompts some nervousness on jobs outlook…

-

….while hikes in health insurance costs, uptick in fuel prices and delay in rate cuts sustain pressure on household finances

Special questions focus on savings and credit card usage

-

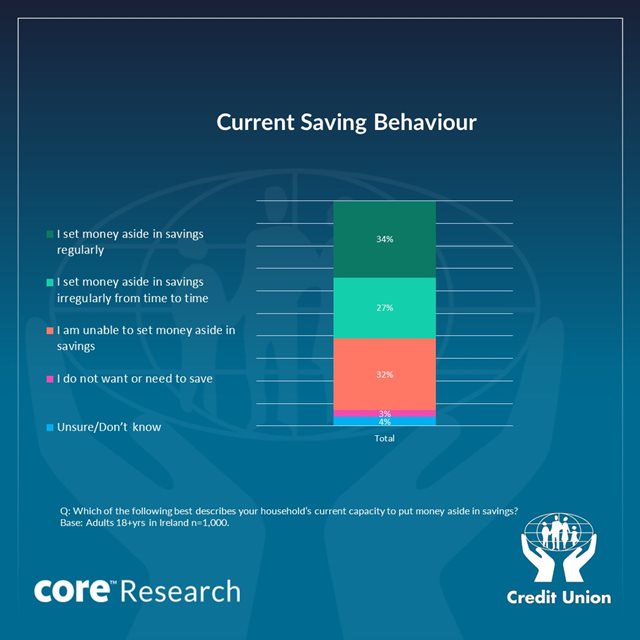

Roughly 1 in 3 consumers saving regularly while a similar number unable to save at all

-

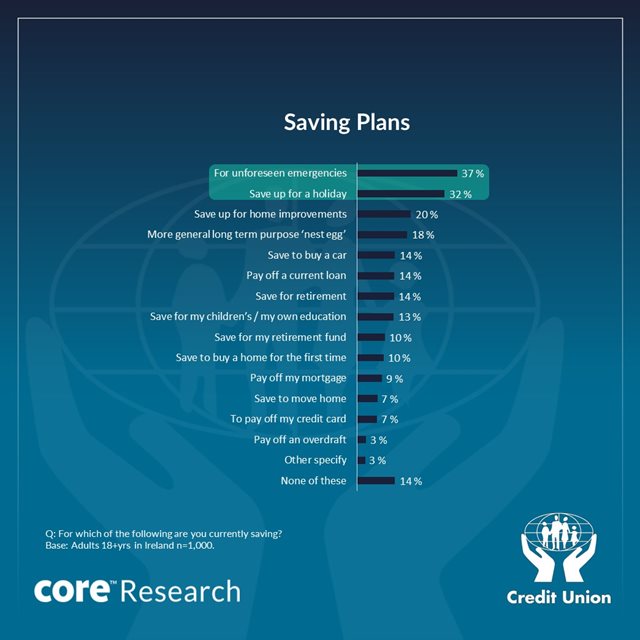

‘Rainy day’ emergency funds the most common reason for saving at present

-

Funding a holiday (getting away from rainy days!!) the second most common reason cited

-

Consumers more likely to save for long-term nest egg than retirement

-

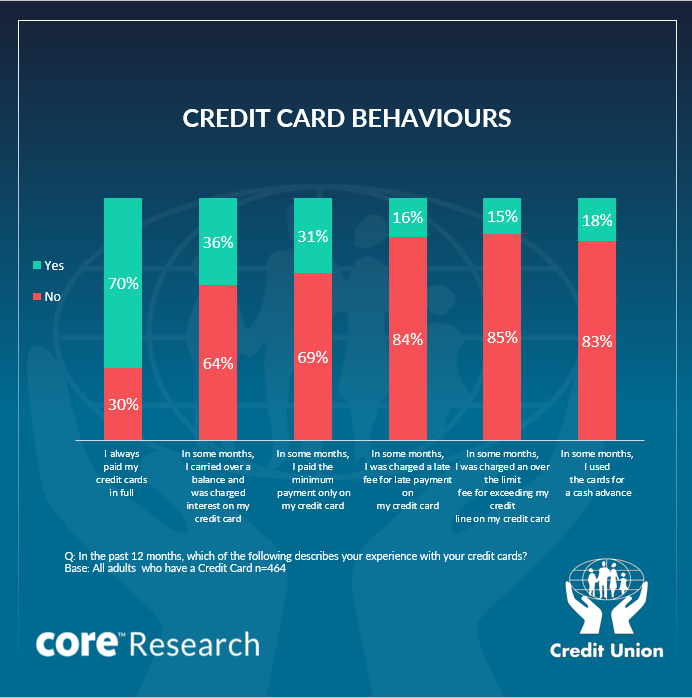

Roughly 2 in 3 consumers say they pay credit card bills in full each month

-

About 1 in 6 consumers incurring extra credit card costs through minimum or late payments, over limit spending or cash advances

Speaking on the release of the February data and analysis, David Malone, CEO of the Irish League of Credit Unions noted; “The February Credit Union Consumer Sentiment index highlights that Irish consumers are saving for a very wide range of reasons at present, reflecting the fact that they make major financial outlays at all stages of their lives. In turn, this emphasises the importance of having the strong support of your local credit union for all the opportunities and challenges that come your way.

This latest round of research comes at a significant time for credit unions and those that we serve, with the recent welcome announcement of the partial commencement of the Credit Union (Amendment) Act 2023. This important piece of legislation will provide tangible benefits to credit unions and members, enhancing the sector so that it can grow its offering and continued support for communities all across Ireland.’ ”.

Summary

The pull-back in Irish consumer confidence seen in February is a not entirely surprising partial correction following an unusually large improvement recorded in January. Against a challenging economic backdrop most consumers face continuing cost-of-living pressures as inflation is retreating rather than reversing. So, a straight line surge in sentiment is not to be expected.

Encouragingly, the fact that the drop in consumer sentiment unwound only about a third of January’s gains, suggests that Irish consumers sense some lessening in the difficulties they have faced of late.

While ‘headwinds’ facing the Irish consumer may be easing, there is still little sense of emerging ‘tailwinds’ that would prompt a sustained positive surge in sentiment.

The road from what has been a pronounced ‘feel-bad’ to even a tentative ‘feel-good’ could be long and bumpy given the large run-up in prices Irish households have endured in recent years as well as the threatening geopolitical landscape and unclear economic outlook they now face.

Section 1; February consumer sentiment reading suggests pressures easing rather than ending

The February 2024 reading of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) came in at 70.2, a 4 point drop from the January reading which had posted an 11.2-point monthly gain (the largest increase in 3 years). Aside from the previous month’s reading, the February consumer sentiment figure is the highest in two years- since the Russian invasion of Ukraine.

As Irish consumer sentiment has fallen between January and February in eight of the past ten years, this month’s reading likely owes something to a harsher reality as arriving bills related to Christmas spending and winter energy costs forcefully mark the end of a seasonal switch-off from economic and financial concerns over the Christmas and new year period.

As the diagram below illustrates, in spite of the setback in the February reading, the underlying trend in the survey, as signalled by the three-month moving average of sentiment readings, continues to move in a broadly positive direction.

Moreover, with the February monthly number above the 3-month average, this trend improvement should continue next month. That said, it remains the case that current sentiment readings remain well below the now twenty eight-year long-term average of the survey.

Putting these statistics in context, our broad takeaway is that Irish consumers seem to sense that the difficulties they have faced through recent years are gradually easing but there is little sign they are anywhere near over.

The general tone of survey responses suggests many Irish consumers feel they remain in a fairly difficult situation and are some significant distance from where they would like to be in terms of a sustained and significant improvement in living standards in a strong and stable economic environment.

Irish and US consumers responding to different degrees of pullback in energy costs?

In contrast to developments in Ireland, consumer sentiment rose fractionally in the US in February. Over the past couple of years, however, as the diagram below suggests, the two metrics have moved in a broadly similar trajectory.

To a significant degree, this is because the main issue for consumers worldwide has been a largely similar and painful experience of a cost-of-living crisis.

Between January 2021 and January 2024, US consumer prices rose a cumulative 18% while the increase in Ireland was 17.8%. Strong as this increase was, consumers on both sides of the Atlantic were notably more pressured by unusually large increases in the costs of essentials. Food prices in the US rose by 20.9% cumulatively over the three years to January 2024. In Ireland, the increase was 20.4%.

One reason why US consumers may be a little more upbeat than their Irish counterparts of late is that energy prices have fallen back sharply there recently and are up 32.3% on a three-year basis. Having increased more and fallen back less, Irish energy prices are up 59.2% over the past three years.

Consequently, elevated energy costs are likely to still be a major issue for most Irish consumers, notwithstanding significant offsetting subsidy payments to Irish households. Another consideration is that most commentary on the US economy has become notably less negative of late as previously widespread fears of recession have faded.

We also note that consumer confidence improved marginally across the Euro area in February but this followed a drop in January that was markedly at odds with the improvement last month in Ireland and to a lesser extent in the US.

Living costs and layoff reports weigh on Irish consumer thinking

While the fall in Irish consumer sentiment was modest, it was broadly based. Moreover, as the scale of decline in the five main elements of the sentiment index was broadly similar, this may suggest a generalised re-assessment of a still testing outlook rather than a downgrade focussed on one specific issue that emerged through the survey period. That said, there were some interesting developments in the past month that may have coloured some of the responses to the February survey.

The smallest drop in the five main elements of the survey came in relation to the general economic outlook. To some extent, this reflects the fact that this element has seen a more modest improvement than other aspects of the survey reflecting continuing concerns about the global economy as well as the impact of ‘tech’ sector adjustments on the Irish economy.

The February reading may also have been influenced by a dearth of ‘macro’ news through the survey period except for encouraging end-year Exchequer returns.

In contrast, the February survey saw a comparatively large pull-back in sentiment towards employment. Although official data signalled a relatively stable and positive picture on unemployment, there were numerous reports signalling the likelihood of future layoffs during the survey period.

There were warnings of further rounds of global cutbacks to come from a range of multinationals with significant headcount in Ireland including Google, Microsoft, Paypal, Ebay and TikTok. Domestically, there were media reports on prospective job cuts at quite a number of high-profile companies including Glen Dimplex, Kerry group, Mediahuis and Three Ireland.

With multiple reports of cafe and restaurant closures adding to a sense of job vulnerabilities, it is scarcely surprising that this area of the survey saw a decline in February. Indeed, considering the recent news flow, the weakness in this part of the survey might be considered reasonably limited, a result that seems to consistent with the health of the jobs market in Ireland signalled in the still strong increase in employment in the latest labour force data for Q4 2023.

Elements of the survey focussed on household spending power weakened more, on average, than ‘Macro’ components in February. The pullback was less pronounced in relation views on how personal finances had evolved over the past twelve months, perhaps reflecting the impact of double welfare payments, electricity subsidy payments and improved social welfare rates and tax credits seen in January.

However, the tone of responses to this element of the survey suggests many consumers regard these fiscal supports as easing rather than fully offsetting continuing pressures on household finances.

Consumers were more nervous in relation to the outlook for household finances in February. The survey period saw some high profile increases in health insurance. It also saw expectations for early interest rate cuts all but disappear and it seems that motor fuel and heating oil costs moved somewhat higher (according to weekly data from the EU Commission and an AA survey on motor fuels). In these circumstances, it is not surprising that the outlook for household finances weakened.

In turn, a still challenging outlook for household finances contributed to a clear pull-back in spending plans. The end of post-Christmas sales and the arrival of bills linked to Christmas spending as well as winter heating costs likely also influenced a more cautious assessment of the buying climate. The Cost-of-Living crisis has markedly altered the capacity of many households to make ends meet currently and their confidence in their future capacity to do so.

Even in circumstances where household incomes look set to rise faster than inflation in 2024, the cumulative hit to living standards over recent years and a related ‘sticker price shock’ as inflation retreats rather than reverses will likely act to constrain the likely pace of increase in overall consumer spending in the Irish economy this year.

Section II; Irish consumers current savings behaviour driven more by fear than future plans while significant numbers incur extra credit card costs

As is the standard practice, the questionnaire for the February reading of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) contained a number of special questions intended to shed light on current consumer thinking on particular topics.

This month these questions focussed on the current savings behaviour of Irish consumers. We also look at the results of a survey of credit card usage habits undertaken with the January survey.

As indicated in the diagram above, roughly 1 in 3 Irish consumers (34%) say they save regularly while a further 1 in 4 consumers (27%) say they save occasionally. Another 1 in 3 consumers (32%) say they are unable to save. So, the survey suggests savings capacity diverges significantly across Irish households.

Not surprisingly, savings capacity is notably greater among those on higher incomes, with comparatively more high-income consumers indicating they saved regularly and relatively few signalling an inability to save. Again, as might be expected, savings capacity was notably less common among those citing difficulties making ends meet at present.

Savings capacity tends to be at its lowest among those aged 45 to 54 and notably greater at either end of the adult age spectrum (consistent with the oft-cited u-shaped age-related wellness curve and, perhaps, driven in this context by a greater incidence of ‘fixed’ family living costs among middle-aged groups) ).

Dublin consumers also signalled greater savings capacity than their counterparts in the rest of Ireland while slightly greater savings capacity was indicated by male respondents than by females.

The February Credit Union Consumer Sentiment Survey (in partnership with Core Research) also asked those consumers who indicated they were saving (regularly or irregularly) the purpose of their current savings behaviour.

The question allowed respondents give more than one reason for their current saving and the results shown in the diagram below reflect the share of ‘saver’ consumers who gave that option as a reason why they were saving.

As the diagram above indicates, the main reason Irish consumers save now is precautionary rather than focussed on a particular future use for those funds.

Just under half of those Irish consumers saving at present (46%) see those savings providing some financial security against unexpected financial emergencies. The likelihood is that many consumers feel that the array of shocks in recent years signal an increasingly unpredictable and threatening world that places a greater importance on having some financial cushion.

Perhaps surprisingly, putting funds aside for a holiday was the second most common reason for saving and cited by 40% of savers. It may be that the experience of protracted difficult economic and financial conditions of late is putting a greater emphasis on ‘getting away from it all’ by taking a holiday. Of course, cost-of-living pressures might also mean that taking a holiday requires greater effort to accumulate the necessary funds for a holiday.

A sense of an unpredictable future likely featured in the thinking of the 25% of savers who indicated their savings were being directed towards a long-term nest egg. This rationale tended to be cited more by those on higher incomes and those not struggling to make ends meet. This reason also figured marginally more frequently among consumers outside Dublin.

It is notable that building a long-term nest egg (cited by 25% of savers) figured more frequently than saving for retirement, which was cited by 18% of consumers. Again, this highlights a significant priority attached to having a financial cushion in an uncertain world rather than putting funds aside for future old age.

In large part, this result is driven by younger consumers who have a greater focus on building a long-term nest egg than on retirement-only in the 45-64 age groups was retirement cited more frequently than building a nest egg as a reason for current saving behaviour.

However, these results might also hint that the concept of ‘retirement’ is not as clearcut for Irish consumers today as it once was. Certainly, the idea of a fixed finishing date for the working life is becoming altogether less prevalent. For various reasons, many consumers may feel that they may want or be forced to continue working well past what used to be the standard age of retirement. As a result, there is less focus on saving for retirement and more on saving for other reasons.

Demographic divergences among a still relatively young population also go some way to explaining why saving for a car was which was cited by 17% of savers is almost as important as retirement savings (cited by 18% of savers).

The significant number of savers citing the need to set money aside for a range of large outlays such as home improvements (25%), education (13%) and first-time home-buying (11%) and moving home (9%) serves to emphasise the varied life cycle financing needs of households and why limited saving capacity may delay a focus on retirement.

Many of those consumers who indicated they were saving at present suggested that at least some element of this was in the form of paying down various forms of debt (mortgages (11%), other loans (11%), credit cards (8%) and overdrafts (3%). In some of these areas, it is likely that consumers see reducing loan balances as a means of building a financial buffer against unexpected unfavourable developments a priority that appears to be a key focus for many Irish consumers at present.

Savings capacity gives some insight into the financial well-being as well as the financial priorities of Irish consumers at present. A complementary perspective is given by their credit card use.

The diagram below, taken from responses asked in the January consumer sentiment survey, suggests that for a sizeable majority of Irish consumers, credit cards offer an efficient and convenient means of purchasing goods and services.

The results shown in the diagram below also hint that, for a significant minority of consumers, credit card usage represents an expensive but likely necessary means of making ends meet and retaining some purchasing power.

.png.aspx?width=640&height=645)

As the diagram above indicates, 70% of consumers surveyed say they always pay their credit card bills in full although the second column suggests occasional slippage by a small number of these, with roughly 1 in 3 consumers (36%) saying they paid interest on an outstanding balance at some point in the past twelve months.

Columns 3 to 6 of the diagram indicate a more problematic tendency to rely on credit cards in a manner that makes for a very expensive means of funding spending. Roughly 1 in 6 consumers paid significant additional charges because of the nature of their credit card use (late payment (16% of consumers), exceeding credit card limits (15% of consumers) or getting a cash advance (18%)).

For many of these consumers, the nature of their credit card likely reflects the impact of significant strains on their household finances and their capacity to fund everyday spending.

The Credit Union Irish Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the Survey. The survey was live between the 1st-12th February 2024.