What Is A Credit Union?

A credit union is a group of people, connected by a 'common bond' based on the area they live in, the occupation they work in, or the employer they work for, who save together and lend to each other at a fair and reasonable rate of interest. Credit unions offer members the chance to have control over their own finances by making their own savings work for them. Every credit union is owned by its members — the people who save with it and borrow from it.

A credit union is a group of people, connected by a 'common bond' based on the area they live in, the occupation they work in, or the employer they work for, who save together and lend to each other at a fair and reasonable rate of interest. Credit unions offer members the chance to have control over their own finances by making their own savings work for them. Every credit union is owned by its members — the people who save with it and borrow from it.

Credit unions exist only to serve members — not to profit from their needs. Surplus income generated is returned to the members by way of a dividend and/or is directed to improved or additional services for members. Members' savings are used to fund loans to other credit-worthy members of the credit union. So, the money in a credit union always remains in the local community or 'common bond' that the credit union serves.

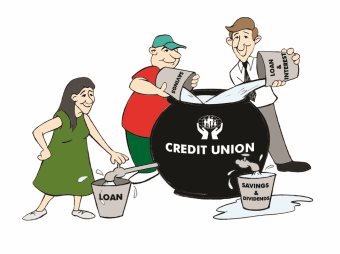

How does a credit union work?

Members save with their credit union and create a communal pool of money available to be used for providing loans to other members. Interest charged on loans to members generates an income for the credit union. Any additional savings not lent out to members can be invested to return a further income to the credit union. From this income, the credit union pays any operational expenses. Any remaining income is referred to as the credit union surplus and funds the dividend paid on members’ shares and/or is directed to improved or additional services for members. Credit unions may also choose to pay a loan interest rebate, which is a refund of loan interest paid to all members who borrowed during the preceding financial year.