April sees Irish consumers less afraid but aware of financial difficulties

Posted on: 27 Apr 2023

-

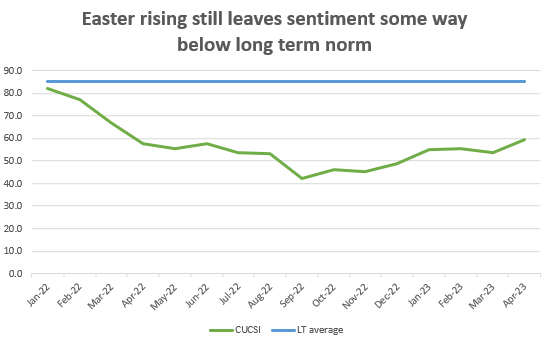

Credit Union Consumer Sentiment Index improves to 13 month high

-

Falling energy costs, less threatening rate outlook and economic upgrades ease consumer fears…somewhat

-

Easter break and anniversary of Good Friday deal may also have helped consumers mood

-

April data suggest trend recovery in consumer sentiment continuing…cautiously

-

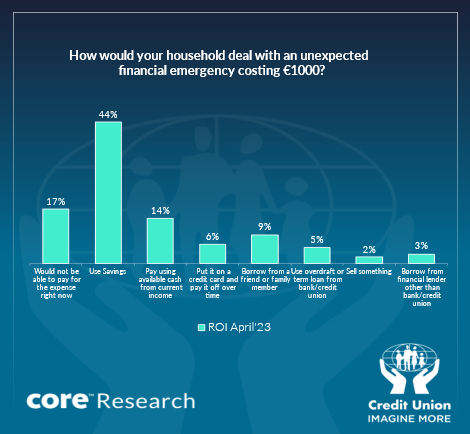

Special question on how households would handle a financial emergency

- Results hint at two-track consumer economy, with notable increases both in consumers who are comfortable and consumers who are just clinging on

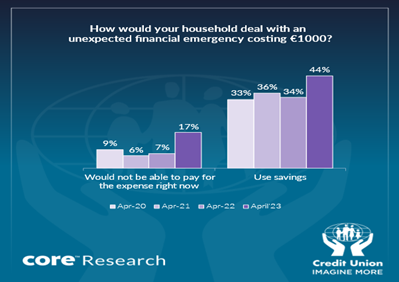

- 44% of consumers would use savings for unexpected financial difficulty-up from 34% in 2022…..but 17% of consumers say they have no way of handling financial emergency-compared to 7% a year ago

Section I; Sentiment strengthens as consumers feel worst fears unlikely to be realised

Irish consumer sentiment improved significantly in April to its best level in 13 months. The increase in confidence was driven by a clear drop in negative views on the economy and household finances. So, stronger sentiment seems to be the result of an easing in fears rather than any sense that conditions are improving markedly at present.

Encouraging as the April sentiment reading is, it still suggests the current mood of the Irish consumer is dominated by uncertainty and caution. Although fears of a full economic or financial meltdown may be fading, many consumers still face significant uncertainty and substantial financial strains.

it may also be that confidence was also boosted by the combination of the Easter break and the anniversary of the Good Friday Agreement which provided consumers with some respite from the normal run of worrisome economic and financial reportage. This might also be inferred from the fact that the 5.4 point monthly rise in the sentiment index was the second largest (after a 6.4 point in the New year-influenced January reading) in 15 months.

The Credit Union Consumer Sentiment Index in partnership with Core Research rose to 59.2 in April from 53.9 in March. This 5.3-point month-on-month rise more than reversed the 1.7-point decline seen between February and March, meaning that a clear if constrained trend recovery in Irish consumer sentiment that began last autumn is still firmly in place.

Not surprisingly, given continuing global economic difficulties and cost-of-living pressures on Irish households, as the diagram below illustrates, the gap between the current reading of 59.7 and the 27-year average of the sentiment series at 85.3 suggests that any recovery in Irish consumer confidence has still some distance to go before it might be considered fully formed.

All five main elements of the Credit Union Consumer Sentiment Index showed month-on-month gains in April. The largest improvement related to the outlook for employment. To a significant extent, this mirrors the resilience of the Irish jobs market to both the global economic step-down following from the war in Ukraine and, more recently to high profile Tech sector job cuts. More specifically, the sentiment survey results chime with the impressive ongoing increase in employment in early 2023 shown in last week’s CSO payroll data that show employee jobs increased by 96k in the year to February.

Consumer thinking on the broader outlook for the Irish economy also improved between March and April but the gain was the smallest of the main elements of the sentiment survey. It was also modest in circumstances where recent economic forecasts continued to show material upgrades to growth and the public finances while headline inflation continued to moderate.

As noted previously, the fact that consumer prices are still rising rapidly means that cost-of-living pressures are continuing to increase rather than ease. It is also case that much of the focus in relation to fiscal matters concentrated on exceptional corporation tax receipts in a manner that could be misconstrued as suggesting serious problems rather than significant opportunity. So, it is not entirely surprising that economic ‘feelgood’ is still in short supply among Irish consumers.

Encouragingly, all three elements of the sentiment survey related to household finances showed clear gains in April. The softer trend in energy costs of late, suggestions that borrowing costs might not rise as far as feared previously and a softer but still positive trend in house prices may all have contributed to a view that financial pressures would not worsen as much as had been widely expected.

This appears consistent with the fact that in all three instances the improvement was largely driven by a drop in negative responses between March and April rather than a rise in positive responses. As a result, the clear message of the survey is one of worst fears not being realised not one that pressures have melted away. A still nervous and cash-strapped Irish consumer may be looking towards a glass that is starting to appear half full rather than one at imminent risk of being drained. In turn, this suggests that while the trend in consumer spending might improve, there is little sense that a major surge in spending is about to be unleashed.

Section II; Would a financial emergency spell a minor difficulty or a major disaster for Irish consumers?

As was the case in each of the previous three years, the April 2022 consumer sentiment survey included an additional question focussed on households’ capacity to weather a financial emergency. This is based on a similar question asked in the regular ‘Report on the Economic Well-Being of U.S. households’ conducted each year by the US Federal Reserve.

The responses given by Irish consumers to the question ‘How would your household deal with an unexpected financial emergency costing €1000? In the April 2023 sentiment survey are shown in the diagram below alongside the responses given in the previous three years.

As the table above illustrates, there have been marked and contrasting changes in the financial wellbeing of many Irish consumers in the past year. These survey findings suggest we increasingly have a two-track economy in terms of the financial well-being of Irish consumers.

In the past year, there were significant increases at both ends of the spectrum-in the number of Irish consumers coping reasonably comfortably with their financial circumstances, but also in the number of financially stretched consumers who have reached the point where they would be entirely unable to manage a further financial mishap.

On the positive side, there has been a clear increase in the proportion of consumers capable of dealing with a financial emergency with comparative ease. The most common response given by some 44% of consumers was that would handle such an emergency by drawing on their savings.

As 34% of consumers indicated they would draw on savings when asked the same question in the 2022 survey, this suggests a significant build-up in ‘precautionary savings by Irish households of late. This seems consistent with responses given to a special question in the February 2023 sentiment survey indicating that some 25% of consumers had built up a ‘war-chest’ of savings for emergency purposes since the pandemic. It would not be surprising if some elements of these savings were initially intended for other purposes but have been re-allocated to ‘rainy day’ funds given notably increased financial uncertainty in the wake of the war in Ukraine.

The resilience of the Irish economy through the past year has also seen a slight increase in the number of consumers able to deal with a financial emergency costing €1,000 from their current income to 14% of those in surveyed in 2023 from 12% a year ago. It might also be suggested that this financial wherewithal would probably allow these consumers undertake a significant step-up in spending if or when current uncertainties fade.

The April 2023 survey saw small declines in the number of Irish consumers who said they would handle a financial emergency by borrowing from various sources and in those who said they would sell something. In part, this may reflect improved income or savings meaning there is no need to borrow. However, it could also be inferred, from the overall tone of responses, that, to a broadly similar extent, declines in ‘borrowing/selling’ responses might be because these avenues have been fully exhausted by some consumers.

Arguably, the most notable aspect of these responses is the sharp increase- to 17% this year from 7% in 2022-in the number of consumers who say they couldn’t handle such an expense through any funds or financial capacity available to them at present. An increase of this magnitude in strained responses from Irish consumers appears entirely consistent with the substantial drain on household financial resources from the surge in living costs seen through the past year.

While all demographic groupings contained significant numbers of consumers who indicated they would be unable to deal with a financial emergency costing €1,000, these responses tended to be more prevalent among those aged between 35 and 54 and among consumers living outside Dublin. These results might be explained by a greater degree of pre-committed family financial outgoings among the ‘middle-aged’ as well as lower incomes and greater spending on much dearer fuel outside the capital.

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The survey was live between the 3rd and 20th April 2023.