One quarter of adults in Ireland living in unsuitable homes

Posted on: 01 Jun 2017

-

National survey of 1,000 adults finds that a substantial number are stuck living in an unsuitable home but cannot afford to move.

-

Surprisingly, over a quarter of those in the 35-54 years age group reported this sentiment – almost on a par with the proportion of 18-34 year olds who felt this way.

-

Almost one fifth of respondents want to extend their current home.

-

One third want to make home improvements in 2017 – but can’t afford to do so.

-

A significant 60% of respondents use their local credit union to fund home repairs and improvements.

A national survey commissioned by the Irish League of Credit Unions (ILCU), found that 25% of adults are living in homes that no longer suit their needs, but are prevented from moving due to the current property market.

Over a quarter (28%) of 18 to 34 year olds said they were living in unsuitable homes but could not afford to move out. Perhaps surprisingly, a quarter of those in the older age group of 35-54 year olds (26%) also felt this way.

The survey, which also looked into home improvement and DIY trends in Irish households, found that almost a fifth are forking out to extend their home, either with an attic/garage conversion - or a built-on extension. Again this trend underlines the finding that a significant proportion of people are living in homes unsuitable for their needs. Overall, the survey shows that home improvements are extremely popular among Irish households - with almost two thirds carrying out home improvements in the past three years.

Commenting on the findings, ILCU Head of Marketing and Communications Emmet Oliver said “It’s troubling that such a substantial portion feel trapped in unsuitable homes, but say the current property market is preventing them from moving out. While most express satisfaction with their long term accommodation, of particular concern is that it’s not just younger generations who believe they are in a home that no longer suits, but a significant portion of the 35-54 age group also feel this way.”

Most popular home improvements

Most popular home improvements

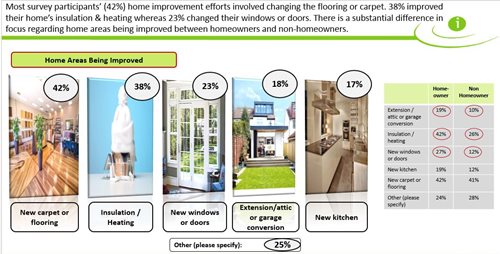

The survey also found that laying down new carpets and flooring is the most popular home improvement with 42% reporting they were upgrading their homes in this way. Installing new heating or insulation systems followed closely behind at 38%. Fitting new windows or doors was the third most popular home upgrade at 23%. The area of their homes most people are unhappy with, and want to change in 2017, is the kitchen (21%), followed by the bathroom (18%) and living room (16%).

A significant 42% of respondents said they would not have €1,000 set aside for an emergency home repair. Credit unions are seen as the go-to solution for this, with a third of respondents saying they would borrow from their local credit union in the event of an unexpected repair.

Mr Oliver commented “We were pleased to see that just 4% of people said they would consider a moneylender to fund emergency repairs, compared with one third who said they would approach their local credit union. Of concern is the finding that four in ten said they would not have €1,000 put aside in case of emergency repairs and we would encourage people to talk to their local credit union for budgeting tips for their household.”

Attitudes to Mortgage Market

More than three quarters of respondents said they would consider taking out a credit union mortgage - and 60% said they would switch to a credit union mortgage. The younger age group showed a keen interest in credit union mortgages with a substantial eight out of ten 18 to 34 year olds saying they would choose such an option.

Commenting on those findings, Mr Oliver said “It’s evident that people feel there has been a lack of options for them in the mortgage market to date. The good news is that the ILCU is developing a centralised structure which will enable credit unions to begin offering mortgages in a significant way by the end of the year.”

Under this new model of operation being developed, individual credit unions will be responsible for the lending decision and will directly offer the mortgage loan to members. The centralised support service will manage the administrative requirements of the mortgage lending process. The ILCU has been working with credit unions for some time to develop a full-service mortgage solution that will meet regulatory requirements.

DIY skills levels among Irish adults revealed

DIY skills levels among Irish adults revealed

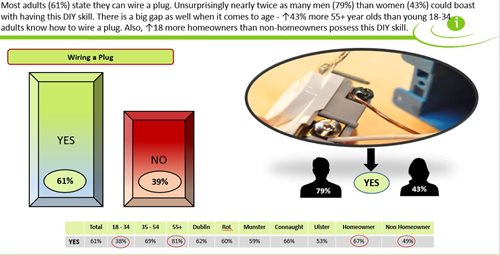

- Four in ten cannot wire a plug

- Twice as many men as women say they can wire a plug– 79% compared to 43%

- Perhaps unsurprisingly, four times more men than women say they are DIY experts – 12% compared with 3%.

- However, almost a quarter of respondents admitted to having to call in the experts to finish a DIY job they started and men were twice as guilty of this - 30% had thrown in the towel compared with 15% of women.

Most skilled by region

- The Leinster region reports to be the most skilled at DIY – 78% say they are either experts or average.

- Munster is the least likely region to rate its DIY skills highly - with 70% reporting to be either expert or average.

- In terms of wiring a plug, Ulster appeared to be the least skilled region - with almost half of adults there admitting they couldn’t do so, while Connaught was the most skilled with two-thirds possessing this basic DIY know-how.

Home Ownership

64% of respondents own the property they live in. 18-34 year olds are still finding it difficult to buy a house with just 38% reporting to own their home. The highest concentration of home ownership was in the Leinster region outside of Dublin (74%), with the lowest concentration in Munster (55%).

Funding Home Improvements

The majority of adults funded their DIY and home upgrades through their savings – 62%. A further quarter said they used their monthly income, while 11% borrowed. Of those who borrowed, the vast majority (60%) used a credit union, with family and friends being the next most popular choice (20%).

Money Set Aside for Emergency Repairs

Young adults feel the financial strain the most with 51% of 18-34 year olds saying they would not have €1,000 to hand for emergency repairs. While in regional terms it was Connaught (51%) and Ulster (64%). A significant one third said they would borrow from a credit union in this instance, while 25% said they would ask family and friends. 15% would use their credit card and just 5% said they would borrow from a bank.

Spending on home improvements

The majority of people spend less than €1,000 on their home improvements (40%). Just over a quarter spend between €1,000 and €3,000 and 10% spend between €3,000 and €5,000. 5% spent over €25,000.

Credit Union Mortgages

Two thirds of adults feel there is not enough competition in the mortgage market at present. There is a considerable appetite for credit unions mortgages amongst Irish adults with 72% saying credit unions should offer mortgages. Three quarters of 35 to 54 year olds and seven in ten 18 to 34 year olds feel this way.

Survey Methodology

The survey was conducted by Market Research Company iReach during the period 23rd February to 2nd March 2017 using iReach Consumer Decisions Research Panel which delivered 1,001 responses from adults in Ireland aged 18+ to 55+ and is nationally representative by age, region, gender and social class. This research has a confidence level of 95% and confidence interval of 4%.