March 2024 - Irish consumer confidence marks time in March

Posted on: 26 Mar 2024

-

Slight drop in sentiment suggests consumers still cautious and concerned

-

Continued increase in living costs and further uptick in fuel costs weigh on thinking on household finances and spending plans

-

Similar sentiment survey findings in US, UK and Euro area suggest consumers now uncertain as to whether economic and financial progress or further problems come next

-

Special questions focus on Irish consumers home improvement spend;

- 37% of consumers say they have made significant home improvement spend in past two years

- A further 25% say they have made painting and decorating spend

- 30% say they have made no home improvement spend

- 45% of those spending on home improvements using savings

- 23% of consumers say their home improvement spend being funded from incomes

- 15% of consumers funding their home improvement spend through credit union loan, 7% through bank loan and 4% through other borrowings

Speaking on the release of the March data and analysis, David Malone, CEO of the Irish League of Credit Unions noted; “The March Credit Union Consumer Sentiment survey highlights that large numbers of Irish consumers are planning to undertake home improvements at present. While much of this work is being paid for from savings and income, it is notable that consumers see their local credit union as the most important source of borrowing for home improvement projects, with twice as many consumers saying they are funding improvements to their homes from credit unions as from banks.

Summary

Irish consumer sentiment edged marginally lower for a second month in March as continuing increases in living costs, disappointing economic news and likely delays in the timing of rate cuts translated into a still challenging environment for many households.

The broad message of the March Credit Union Consumer Sentiment Survey (in partnership with Core Research) is that while it may no longer be the worst of times, it is still far from the best of times. Upward pressure on living costs may have eased but hasn’t reversed and the economic outlook remains extremely uncertain.

The gradual, if uneven, fading of negative factors on consumer confidence is not presently being accompanied by the emergence of strong positive developments in relation to the economic and financial conditions experienced by Irish consumers.

While forecasts envisage rising living standards for Irish consumers in the coming year, the sense of still significant pressure on household finances remains broadly based. As a result, there is still a lack of positive momentum to move consumer sentiment from the entrenched ‘feel-bad’ of recent years to a broadly based ‘feel-good’.

Section I; Irish consumers less gloomy but not feeling great

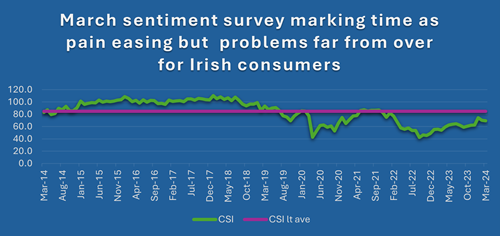

The March reading of the Credit Union Consumer Sentiment Survey (in partnership for Core Research) at 69.5 shows a fractional decline from February’s 70.2 outturn. A small decline of this order should be seen as signalling no significant change in the mood of Irish consumers.

While the effectively unchanged March sentiment reading implies that the trend improvement seen in the early months of 2024 is being sustained, it also suggests that Irish consumer confidence remains subdued, as a comparison of the current level of the sentiment index and its long-term average of 84.6 also indicates (see diagram below).

Sentiment broadly steady elsewhere in March

The sense of a holding pattern in consumer sentiment in March seen in the Irish survey data was also evident in corresponding indicators elsewhere. The preliminary sentiment release for the US dipped fractionally (to 76.5 from 76.9), consumer confidence for the Euro area saw a marginal improvement (from 15.5 to -14.9) and UK consumer confidence was unchanged from February.

A common ingredient in sentiment indicators globally at present appears to be an element of relief that energy-led price pressures are easing but this is offset by continuing strains on spending power and ongoing concerns about the economic outlook.

As a result, a widely seen improvement in consumer confidence measures at the start of the year appears to have stalled as consumers wait for clearer evidence that a sustainable improvement in their circumstances is at hand.

With a pressing election timetable in many countries adding a further element of uncertainty to financial prospects for households, it is scarcely surprising that the global picture seems to be one of consumer confidence stabilising at levels that are clearly better than those of recent years but still relatively weak by historic standards.

Continuing pressure on household finances a concern in March

In terms of the details of the Irish data, four of five of the main elements of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) weakened between February and March. The exception was consumer thinking on the outlook for jobs which recovered following a significant decline in February.

One reason for the uptick in the jobs element this month is that the latest survey period didn’t see the spate of layoff announcements reported in February. Another is that the survey period saw the release of official data showing a drop in unemployment in February and continued healthy job gains in late 2023.

The other ‘macro’ element of the March survey, which is focussed on the general economic outlook was fractionally weaker this month. Official data reported a sharp drop in Irish GDP in 2023 and while the average consumer may not be entirely appreciative of the nuances around Irish National Accounts data, there is little doubt that the term ‘recession’ resonates strongly, particularly in circumstances where it chimes with pressures on consumers own financial circumstances.

The largest monthly decline came in consumer thinking on way their own financial circumstances had evolved over the past year. Recent EU data suggest motor fuels saw a further price increase albeit modest in early March. This is a very visible and high-frequency element of household costs and, given its central role in the recent cost surge, a very important metric of far household spending power can stretch at present.

With increases in excise set to kick in and boost motor fuel prices further in coming months, it is to be expected that even small increases in fuel costs would weigh on consumer thinking.

In the same vein, while the annual rate of inflation eased further in February, there was a significant monthly rise in consumer prices that likely carried into March as new ranges of clothing and household goods appear in the shops. So, the message of the survey is that consumers are more focussed on a continuing increase in the costs they face than in the fact that the pace of increase in prices is slowing.

For these reasons, consumers likely downgraded their assessment of how their spending power is evolving. A further factor may be the confirmation in a new Central Statistics Office release on living conditions of the widespread perception of a decline in ‘real’ or inflation adjusted value of household incomes and a related increase in numbers at risk of poverty.

That said, the March sentiment survey period also saw new Central Bank forecasts hold out the promise of ‘real’ improvements in household spending power in coming years, a prospect that may have contributed to a notably smaller weakening of the outlook for household spending power through the next twelve months.

Not surprisingly, a poorer assessment of both ‘macro’ prospects and purchasing power caused a further pull-back in consumers’ spending plans in March. Notwithstanding this result, it would not be surprising to see some positive impetus to spending from the Saint Patrick’s festival and an early Easter. However, the sentiment survey suggests the continuing lack of a forceful spring in consumer spending.

Section II; Most consumers now undertaking home improvements but spending cautious rather than carefree

As is usual, the questionnaire for the March reading of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) contained several special questions intended to shed light on current consumer thinking on particular topics.

This month’s focus was on Irish consumers’ current and planned spending on home improvements. National Accounts data suggest just over €9 billion was spent on home improvements in Ireland in 2023 (roughly divided between major and minor works and accordingly split between investment and consumer spending). This is modestly higher than the amount spent on new homes and amounts to around 8% of household income. As such, it is a significant element of overall economic activity as well as a substantial portion of the financial outlays of Irish households.

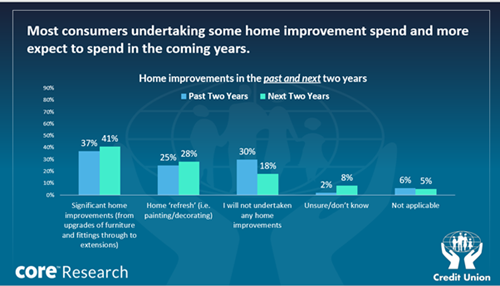

As the table below indicates, approximately two out of three Irish consumers (62%) say they undertook some form of spending on home improvements in the past two years. It is perhaps surprising that as many as 37% of consumers say they undertook significant work compared to 25% who say their focus was on ‘refreshing’ their home by painting and decorating.

Younger consumers were more likely to say they undertook significant home improvement work, probably reflecting property purchases and changes in household size. Not surprisingly, spend on home improvements was positively correlated with income and negatively correlated with difficulty in making ends meet. Male respondents were also more likely to say they had undertaken significant home improvement spend than females.

Older consumers were more likely to say they had undertaken ‘refresh’ home improvement spend in the past two years. Again, unsurprisingly, this type of spend was positively correlated with income.

A significant 30% of Irish consumers say they didn’t undertake any home improvement spend in the past two years. Within this group, the form of tenure and previous work undertaken may be some of the reasons why they didn’t spend on home improvements in recent years.

This response tended to be more prevalent among consumers indicating difficulties making ends meet. With just 18% of consumers saying they won’t spend on home improvements in the next two years, the likelihood is that cost-of-living pressures curtailed spending on home improvement in the past two years.

The diagram above suggests that more consumers are set to spend on either significant or ‘refresh’ home improvement in the next two years (69% compared to 62%) but there is also a large increase in numbers who don’t know if they will undertake home improvements (from 2% to 8%).

This increased uncertainty was common to all demographics, which might hint at a material element of uncertainty regarding the general economic outlook as well as household spending power, and, perhaps, specific imponderables that may make some consumers unclear about how their housing circumstances may evolve in coming years.

The March Credit Union Consumer Sentiment Survey (in partnership with Core Research) also asked consumers how they are funding their home improvement spend.

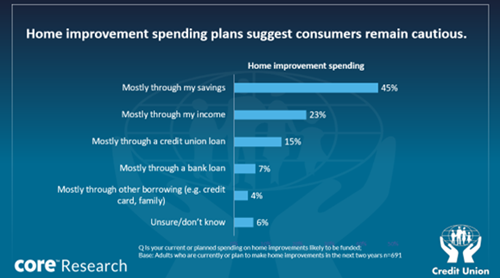

As the diagram below indicates, the most common approach, cited by almost half of those consumers (45% of respondents) undertaking home improvements is that they intend to use their savings. Not surprisingly, this response tended to be more prevalent among those with higher incomes, among those not having difficulty making ends meet, and among older consumers.

Roughly one in four consumers (23%) say they will finance their home improvement spend from their current incomes. There was no strong correlation between these responses and respondents’ incomes or ages. Home improvements financed through income are more commonly mainly minor outlays such as painting and decorating rather than major structural works.

While there has been a trend increase in personal borrowing in recent years, the survey results may hint at a continuing caution on the part of Irish consumers about taking on debt, as the diagram illustrates.

Just one in four consumers (26% of respondents) say they will borrow to finance their home improvement spend. Within this group, borrowing from credit unions is about twice as prevalent as borrowing from banks (15% against 7%) and borrowing on credit cards or from family is even less common (4%).

Borrowing to fund home improvements tended to be more prevalent among those aged 25 to 44. This response was also more commonly seen among those consumers citing difficulty making ends meet. This might suggest that, for significant numbers of consumers, the associated spend relates more to necessary repairs and refurbishment rather than ‘improvements’ per se.

The Credit Union Irish Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the Survey. This month’s survey was live between the 6th – 18th March 2024.