Slight further drop in sentiment suggests no spring in consumers step

- April sees third drop in a row for consumer confidence

- High-profile price increases and layoff announcements dent hopes for better environment for consumers

- Irish consumer sentiment slipping more than elsewhere of late

- Special question suggests holiday spending will be slightly less strained than a year ago

- 23% of consumers say they can’t afford a holiday (V 27% in 2023)

- 28% say their holiday spend will be the same as last year

- 24% say they will spend more on their holiday than last year

- 15% say their holiday spend will be down on last year

Speaking on the release of the April data and analysis, David Malone, CEO of the Irish League of Credit Unions noted; “The April Credit Union Consumer Sentiment Survey suggests that while conditions are not quite as difficult as they were, many Irish households are still under significant financial pressure and worried about a still uncertain economic outlook. As always, credit unions are on hand to support their members through these difficult times".

Summary

Irish consumer sentiment fell marginally for the third month in a row in April as ongoing price increases and uncertainty about the economic outlook continue to weigh on the mood of consumers.

After a very difficult couple of years, a clear sense that conditions had stopped getting worse and worse prompted a significant improvement in Irish consumer confidence late last year but the modest slippage in sentiment in recent months suggests things are not getting better as fast or as forcefully as many consumers had expected.

An easing in inflation and a still solid Irish economy mean consumers are not nearly as nervous as they were either six or twelve months ago. These developments signal recent changes in consumer circumstances are clearly insufficient to suggest a clear improvement in living standards is underway.

Strains on household spending power remain widespread as evident in a wide range of high-profile price increases in April. In the same vein, this month saw another spate of layoff announcements that increase concerns around job security.

As a result, while consumer confidence no longer suggests fears of a slump, sentiment remains subdued. In turn, this hints that consumer spending will remain sluggish rather than surge.

Section I; April survey suggests no spring in Irish consumers step

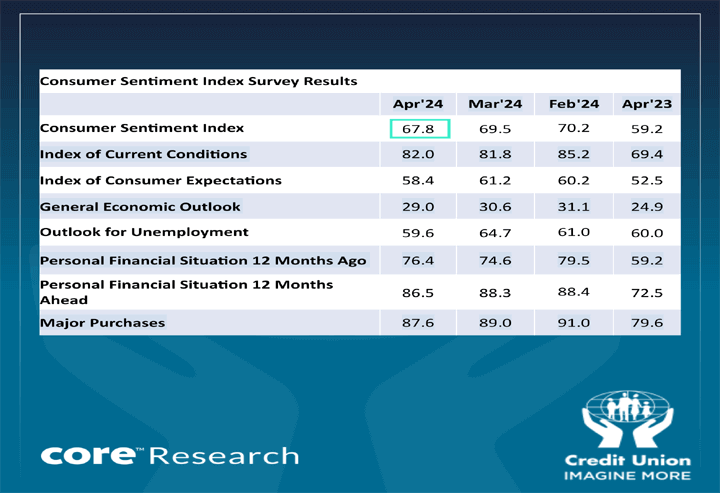

The Credit Union Consumer Sentiment Survey (in partnership for Core Research) shows an index reading of 67.8 for April, down modestly from the March figure of 69.5. The April reading marks the third monthly decline in a row following four successive monthly increases between October and January.

Importantly, the 6.4-point cumulative drop in the sentiment index over the past three months is less than half the cumulative gain seen in the previous four months. So, the current reading is suggesting that Irish consumers are not quite as negative now as they were previously. That said, the current reading at 67.8 is significantly below the long-term average of 84.6 for the consumer sentiment survey, implying consumer confidence is quite subdued at present.

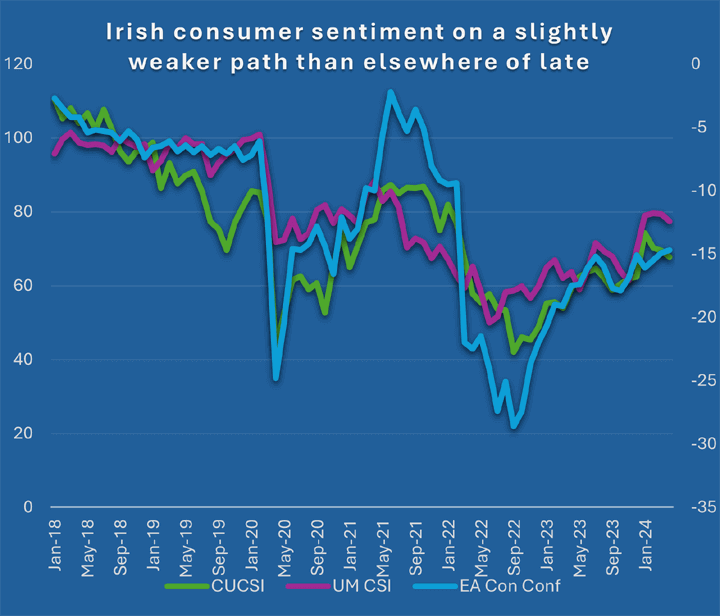

The fall in Irish consumer sentiment in April was mirrored in a modest but larger than expected fall in US consumer sentiment that has been attributed to slightly higher than expected inflation of late. The preliminary reading of Euro area consumer confidence showed a fractional improvement in April that could be linked to a notably slower inflation rate of late.

As is the case with the Irish consumer sentiment figures, the fractional changes in corresponding measures for the US and Euro area suggest no dramatic change in consumer thinking of late. However, as the diagram below illustrates, the softness of recent Irish consumer sentiment readings relative to other similar surveys suggests some element of domestic-centred disappointment may be weighing on the mood of Irish consumers.

Four of the five key elements of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) posted weaker readings in April than in March. The largest fall was in relation to the outlook for jobs.

The jobs element of the sentiment survey has been quite volatile since late last year, with monthly readings swinging between clear gains and losses. In part, this is because there has been quite a lot of ‘noise’ around the Irish jobs market during this period with the positive effect of strong readings in official employment data significantly offset by a range of high-profile layoff announcements and increased concerns around prospects for the ‘tech’ sector.

The April survey period saw the publication of a report suggesting that restaurant closures could have led to nearly 1600 job losses in February. There were also reports of significant numbers of layoffs at a range of companies including Citigroup, Tara mines, TikTok and Mediahuis.

In addition, a number of analyses from recruitment companies highlighted a sharp fall in job vacancies in the first quarter of 2024. Unemployment data also showed a small uptick, albeit to still relatively low levels with the jobless rate for March reported at 4.3%.

Recent sentiment survey readings might suggest Irish consumers are grappling with the implications for them of an Irish jobs market that is still healthy but no longer ‘white-hot’, where layoff risks have increased materially across a range of sectors and salary levels, and new job offers have become less plentiful. In these circumstances, it is not surprising that the jobs element of the survey has become notably choppier from month to month.

The other ‘macro’ element of the Credit Union Consumer Sentiment Survey (in partnership with Core Research), that is focussed on the general economic outlook registered only a fractional drop in April. A positive assessment of Irish economic prospects in the latest ESRI forecast and healthy Government Finances figures released during the survey period likely offset partly the influence of a threatening geopolitical situation globally and still subdued conditions in trading partner economies such as those of Europe and the UK.

The one element of the sentiment survey that showed an improvement between March and April was that focussed on household financial circumstances through the past year. It should be noted that the level of this element of the survey still suggests notably more consumers felt their financial circumstances had worsened than the number reporting an improvement but there was a small narrowing of the gap between positive and negative responses to this question in the April survey.

Our sense is that the easing in concerns in relation to past trends in household finances likely owes something to high profile media focus on the drop in inflation to is lowest rate in more than two and a half years, and, in particular, the drop in grocery price inflation to its slowest pace in two years. In addition, the survey period saw the payment of the third €150 instalment of the Government’s electricity account credit.

In stark contrast to the slight improvement in consumer thinking on their personal finances over the past year, the April survey saw a continued weakening in consumer thinking on the prospects for their household finances in the year ahead.

This likely reflects a number of high-profile price increases taking effect in April and ranging from higher excise duty on motor fuels to increased charges for broadband, mobile and tv services. In some instances, the charge based on a formula related to the January inflation rate plus an additional 3% amounts to a significant uplift in regular household bills.

Not surprisingly, considering strained household finances and emerging concerns about job security, Irish consumers buying plans fell for the third month in a row. We would again highlight that this result should be seen as suggesting that Irish consumer spending will be cautious but it doesn’t signal a pull-back. Indeed, increases in population and numbers at work imply healthy growth in household outlays. However, the sentiment survey continues to suggest the increase will be decent rather than dramatic.

Section II; Sentiment survey suggests holiday spending marginally less strained in 2024

As is usual, the questionnaire for the April reading of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) contained several special questions intended to shed light on current consumer thinking on particular topics.

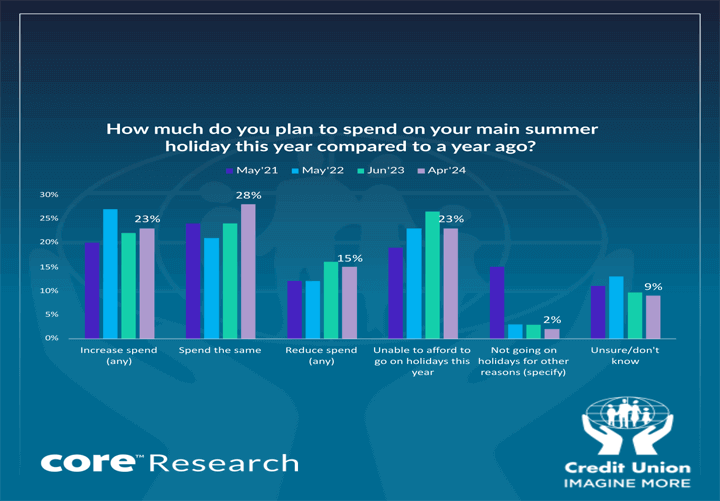

This month’s focus was on Irish consumers’ summer holiday spending plans. As the diagram below indicates, Irish consumers appear to be in a slightly stronger position in terms of their holiday spending power now than they were a year ago. However, the diagram also hints that the vast majority of consumers will not be spending more on holidays this year, suggesting ‘discretionary’ spending power is limited for most Irish households.

Some 23% of Irish consumers say they cannot afford to go on holidays this year, modestly down from 27% in 2023 and broadly similar to the 2023 results (also 23% of consumers) when the cost-of-living crisis was taking hold.

This might be interpreted as signalling some easing in cost-of-living pressures but the limited scale of improvement and the still substantial number of consumers unable to afford a holiday chimes with the message from the sentiment survey as a whole that progress is quite modest.

While the demographic picture painted by responses to this question was mixed with all response choices capturing significant numbers of all age, income and gender categories, there were some differences in relative response rates. Female respondents were notably more likely to say that they can’t afford a holiday than males, younger age groups were less likely to say they can’t afford a holiday with those aged 45-54 the age group most likely to say they can’t afford a holiday. Those citing difficulties making ends meet were seven times more likely to say they can’t afford a holiday than those making ends meet without difficulty.

At the other end of the response range, the proportion of consumers who say they will spend more on their holiday than a year ago was effectively unchanged from the 2023 survey (23% now against 22% previously). This response was more prevalent among males than females, among the under 35’s and more than twice as likely to come from those citing no difficulty making ends meet than among those indicating difficulties in this regard.

Some 15% of consumers say they will cut back on holiday spending in 2024, effectively unchanged from the 16% of consumers who gave this response in the 2023 survey. This response was somewhat more prevalent in the 25 to 44 age groups than elsewhere and among those citing difficulties in making ends meet.

The most common response given-cited by 28% of consumers- was that they would spend the same as a year ago. This is up modestly from the 24% of consumers who gave this response in 2023, hinting that cancelling holidays is not quite as central to consumer thinking now as it was a year ago. This response was more prevalent among those at either end of the age spectrum, possibly reflecting fixed income constraints.

Overall, responses to the question on holiday spend echo the message of the broader sentiment survey that Irish consumers are not quite as worried about their economic and financial circumstances as a year ago but that progress in the interim has been relatively limited and significant concerns continue to weigh on sentiment and spending plans.

The Credit Union Irish Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the Survey. The survey was live between the 3rd-17th April 2024.