August 2023 Consumer Sentiment Index | Published: 24/08/23

Living costs and layoffs dampen Irish consumers mood in August while ECB rate hikes add to gloom

-

Living costs and layoffs dampen Irish consumers mood in August while ECB rate hikes add to gloom

-

Sentiment slips for first time in 5 months

-

Economic and financial clouds mirror gloomy weather

-

Consumers more negative about household finances…

-

… but spending plans holding up

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The August survey was live between the 1st and 14th August 2023.

Irish consumer sentiment weakened for the first time in 5 months in August. Negative news on jobs and the global economy together with continuing cost of living pressures dampened the mood of consumers. Poor weather could also have added to the gloom and contributed to the softest consumer confidence reading since April.

The pullback in the Credit Union Consumer Sentiment Index (in partnership with Core Research) in August isn’t entirely surprising. Although the Irish economy and consumer spending power have avoided the collapse feared in the 14-year low seen in the survey in September 2022, the global economic outlook remains at very best uncertain, and many Irish households remain under significant financial pressure.

Like the summer weather, the August sentiment survey testifies to a distinct lack of economic and financial ‘sunshine’ that would be needed to make Irish consumers feel significantly positive about their circumstances. As a result, it could not be expected that the Credit Union Consumer Sentiment would continue to show an uninterrupted improvement.

Section I; August is a damp month for Irish consumer sentiment

The August reading of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) stands at 62.2, modestly down from 64.5 in July. However, that 2.3-point drop was sufficient to push the sentiment index to its lowest level in 4 months (April 2023 reading 59.2), emphasising that the improvement in sentiment in recent months has been relatively limited.

Again, this suggests the fairly tepid pick-up in confidence in recent months has largely reflected the absence of major negative news rather than the clear emergence of markedly more favourable conditions for the average Irish consumer.

Four of the five key elements of the Credit Union Consumer Sentiment Index (in partnership with Core Research) weakened month-on-month in August. Both ‘macro’ elements reported a clear if modest softening. A largely negative news-flow through the survey period encompassed talk of additional interest rate increases and further risks to the global economic outlook centred on emerging weakness in China.

A somewhat larger drop in the jobs element of the survey likely reflected layoff announcements, most notably those at Accenture. In addition, The Central Statistics Office monthly payroll index for June indicated that despite reports of a buoyant jobs market, the number of employees at work has remained flat over the first half of the year.

Consumer thinking on the outlook for household finances through the next 12 months was the element of the survey that saw the largest monthly drop, with views on the past twelve months weakening only slightly less. Once again, consumers may be reacting negatively to the contrast between reports of falling inflation and their own experience of sustained upward pressure on prices.

The August survey period saw concerns about winter fuel costs amplified by reports of renewed upward pressure on European wholesale gas prices while there were also warnings of more expensive food bills because of war and weather-related disruptions to supply. In addition, high profile price increase announcements from companies ranging from drinks producers to streaming service providers underscored that already strained cost-of-living pressures could worsen.

Against this backdrop, it may seem rather surprising that the one element of the August survey that improved month-on-month was consumers’ spending plans. Although the monthly rise was modest, it was sufficient to lift the buying climate to its best level in 17 months. We can suggest two distinct strands to a possible explanation for this result.

First of all, it should be noted that the spending plan element of the Credit Union Consumer Sentiment survey (in partnership with Core Research) remains quite weak at current levels, with only 1 in 8 consumers indicating that now is a good time to make major outlays. Indeed, the proportion of consumers reporting now is a good time to buy fell fractionally between July and August but there was also a somewhat larger fall in the number of consumers indicating that now is a bad time to make ‘big ticket’ purchases. So, the improvement in this element appears to stem from an easing in concerns rather than a surge in ‘feel good’. Accordingly, it might be expected that any pick-up in consumer spending may be phased rather than forceful.

A combination of ‘macro’ factors could offer a second possible explanation for increased spending plans. One of these could be attractive pricing in summer sales in part caused by poor weather that would have prompted substantial discounting of summer stock. A related influence may be a continued easing in global supply bottlenecks that improved the availability and, in many instances, encouraged special offers on cars and some electrical goods.

Furthermore, many Irish households appear to have postponed purchases of consumer durables in recent years meaning that as the extreme fears of pandemic and war in Ukraine have abated there is some catch-up in the normal replacement cycle. Finally, Government measures such as the zero VAT rate on solar panels may be boosting planned spending on energy upgrades ahead of winter.

For these various reasons, some pick-up in consumer spending may be seen in the months ahead but the general tone of the Credit Union Consumer Sentiment Survey (in partnership with Core Research) for August suggests many Irish households are unable and/or unwilling to increase their spending materially in current circumstances.

Section II; ECB interest rate increases, all pain, no gain?

Over the past year or so there has been a dramatic change in interest rate policy around the world in response to the surge in inflation. To get some sense of consumer thinking on the likely impact of markedly higher borrowing costs, the Credit Union Consumer Sentiment Survey (in partnership with Core Research) for August asked a number of special questions about the perceived effects of the nine increases in policy rates by the European Central Bank (ECB) since July 2022.

There is some debate among economists as to how successful or not interest rate policy may be in curbing inflation in the face of major shocks. However, there is a broader agreement that the process is likely to entail a fair measure of pain for the economy. This view was famously captured by the then British chancellor, John Major, who in 1989 suggested in relation to a sharp sequence of increases in UK official interest rates that ‘if it isn’t hurting, it isn’t working’.

One interpretation of the responses to special questions in the August Credit Union Consumer Sentiment Survey (in partnership with Core Research) is that Irish consumers seem to feel that ECB rate hikes are hurting quite a lot, but they may not be working in terms of markedly altering the outlook for inflation.

Rate increases seen hitting household finances hard…

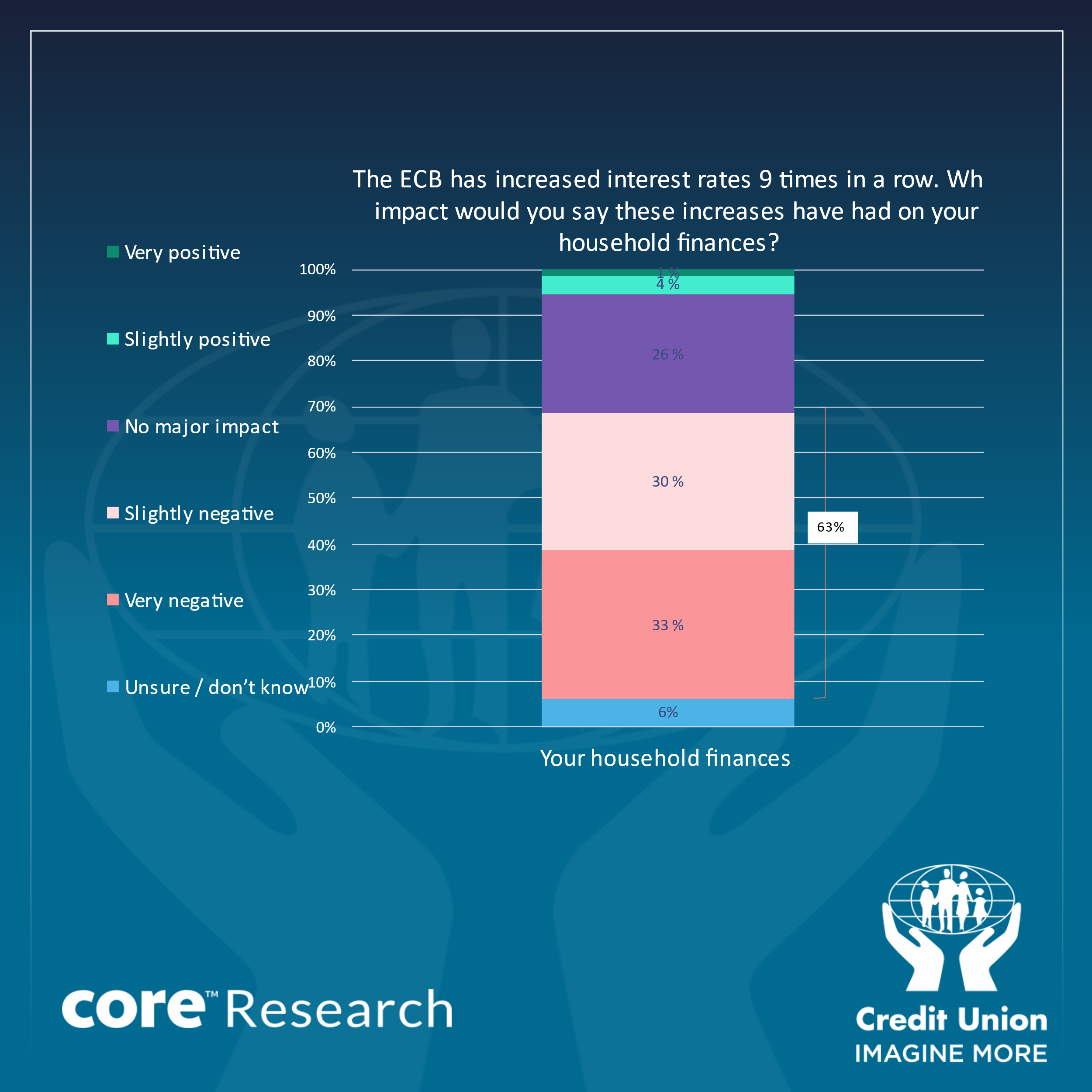

The diagram below shows consumers’ responses to the question as to the impact of ECB rate increases on their own household finances. As the table indicates, roughly 2 out of 3 Irish consumers (63%) believes ECB rate increases have had a negative impact on their household finances, with more than half of this group indicating the impact on their personal financial circumstances would be ‘very negative’.

As Census data suggest that only a third of Irish households have mortgages and recent Central Bank of Ireland (CBI) research (The interest rate exposure of mortgaged Irish households). David Byrne, Fergal McCann and Edward Gaffney, CBI Financial Stability Notes, April 2023) suggests that roughly 40% of current mortgages have a fixed interest rate stretching for more than three years, the intensity of responses to this survey question may require some explanation.

The CBI research cited above also indicates that the average monthly mortgage repayment of Irish mortgage holders is likely to rise 16 per cent and, given that those on fixed rates will see no increase, this implies the average monthly mortgage repayment increase of affected borrowers will be around 25%. Indeed, the same CBI research indicates that the 20% of borrowers most affected will see their average monthly mortgage repayments rise by 50% on average. These findings are consistent with the strength of the responses in the August Credit Union Consumer Sentiment Survey (in partnership with Core Research).

While most discussion around ECB interest rate increases centres on the impact on mortgage borrowers, many other groups are directly affected. CBI data indicates there are 1.274 million personal credit cards in active use in Ireland. Research undertaken by the Irish League for Credit Unions earlier this year suggested that 35% of borrowers did not clear their credit card bill each month and roughly half of these only made the minimum payment.

Other distinct groupings are also likely to be adversely affected by interest rate increases. Those planning to buy a house will see their borrowing capacity reduced while renters may fear a knock-on impact towards higher rents. In addition, through the impact on asset values discount rates, pension pots may also be hit- for many of these individual, these capital losses may outweigh any boost from limited increases in deposit rates. As a result, the number reporting a positive impact on their household finances is quite small at 1 in 18 consumers (6%). However, for a wide range of reasons, the number of Irish consumers reporting a negative impact on their household finances from higher interest rates may not be as surprising as it appears, particularly in circumstances where cost of living pressures are already hitting household finances quite hard.

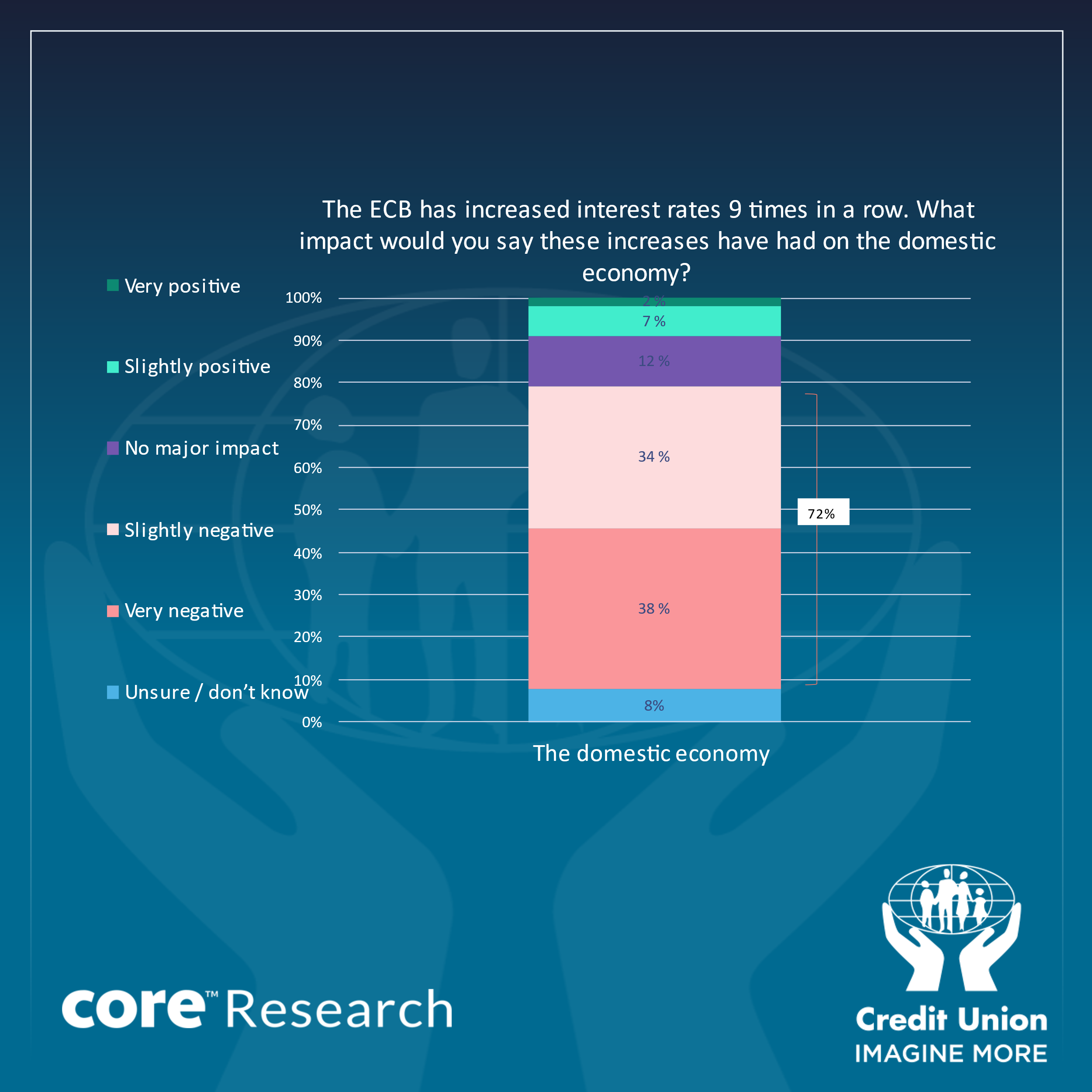

….And rate hikes seen hitting the economy even harder

Not surprisingly, the August Credit Union Consumer Sentiment Survey (in partnership with Core Research) found that consumers were even more negative in their assessment of the impact of higher ECB rates on the Irish economy than on their own household finances. As the table below indicates, almost 3 out of 4 Irish consumers think higher Interest rates will damage the Irish economy (72%), with the majority of these suggesting the impact will be very negative.

These responses tally with recent CBI research findings that suggested the cumulative tightening of ECB policy could reduce employment in Ireland by 3 per cent, equivalent to a hit to jobs of almost 80k (modelling the macroeconomic impact of the ECB’s interest rate rises on the Irish economy By Matija Lozej, Gerard O’Reilly, and Graeme Walsh, CBI quarterly bulletin 2 2023, p 39).

In contrast, the sentiment survey found that 1 in 11 consumers (9%) think there will be a positive effect-that we might speculate reflects a view that higher interest rates will reduce feared ‘overheating’ risks. The same CBI research suggests ECB policy tightening could reduce inflation by 2-2.5% this year and next. This suggests a very painful ‘sacrifice ratio’ in terms of the hit to jobs associated with a modest reduction in inflation.

Consumers feel rate hikes are harming rather than helping with the cost-of-living

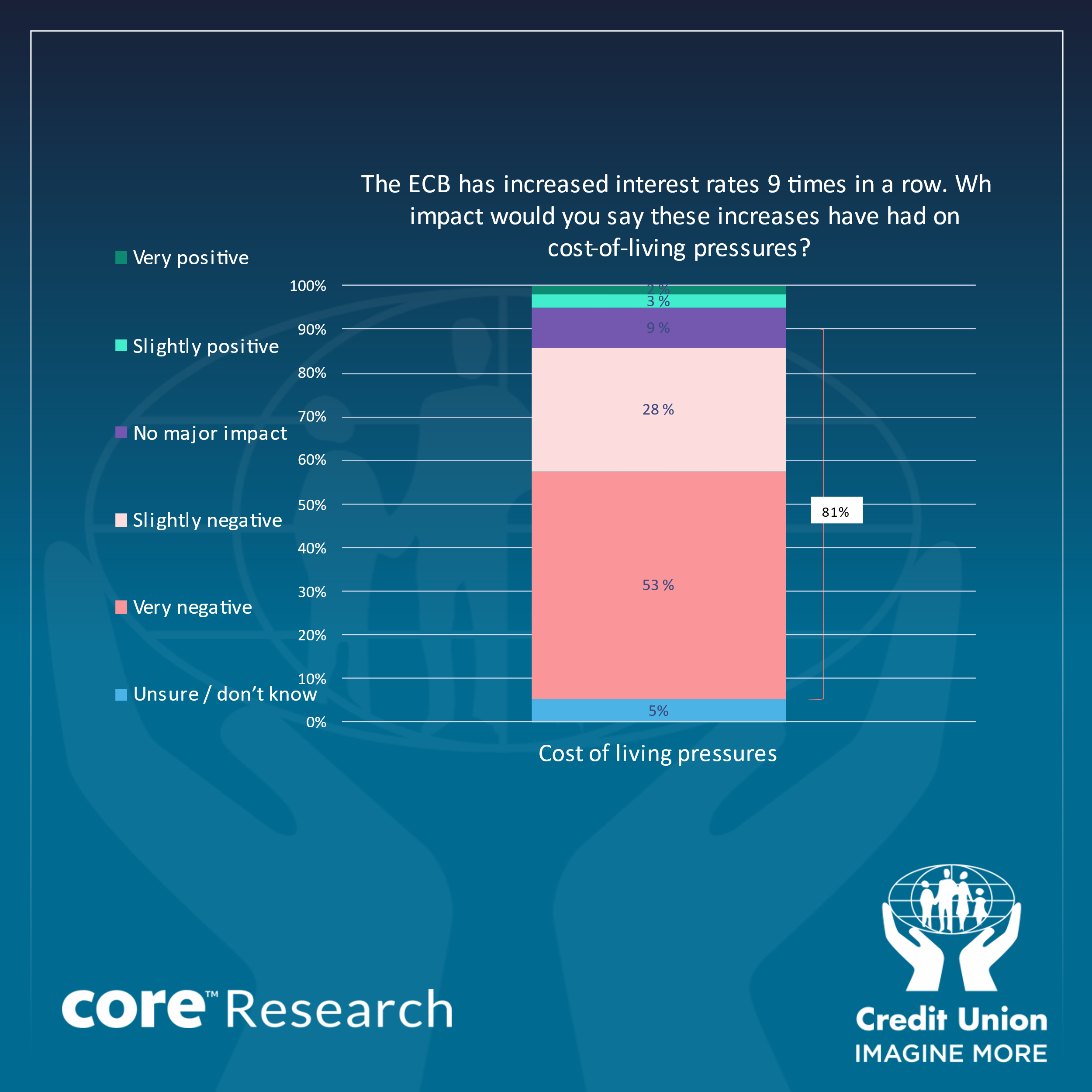

The purpose of ECB rate hikes is to reduce inflation but economic theory suggests that this may happen over a ‘long and variable’ timeframe. It is also the case that the headline Irish inflation measure includes mortgage payments, meaning that when interest rates rise, there is a mechanical boost to the inflation figure. For these reasons, the August Credit Union Consumer Sentiment Survey (in partnership with Core Research) asked a more basic question – how Irish consumers thought higher rates would affect the cost-of-living pressures they faced.

The responses shown in the table above suggest that 4 out of 5 consumers (81%) see higher rates adding to cost of living pressures, with just 1 in 20 (5%) saying higher rates would reduce cost-of-living pressures. This suggests the vast majority of Irish consumers think the direct impact of higher borrowing costs will outweigh the more indirect restraining impact tighter ECB policy will have on demand and, consequently, on the pace of increase in consumer prices.

These results are consistent with responses to a special question in the July sentiment survey which found that Irish consumers felt that, after energy costs, higher interest rates were seen as the most significant threat to the cost of living in the year ahead.

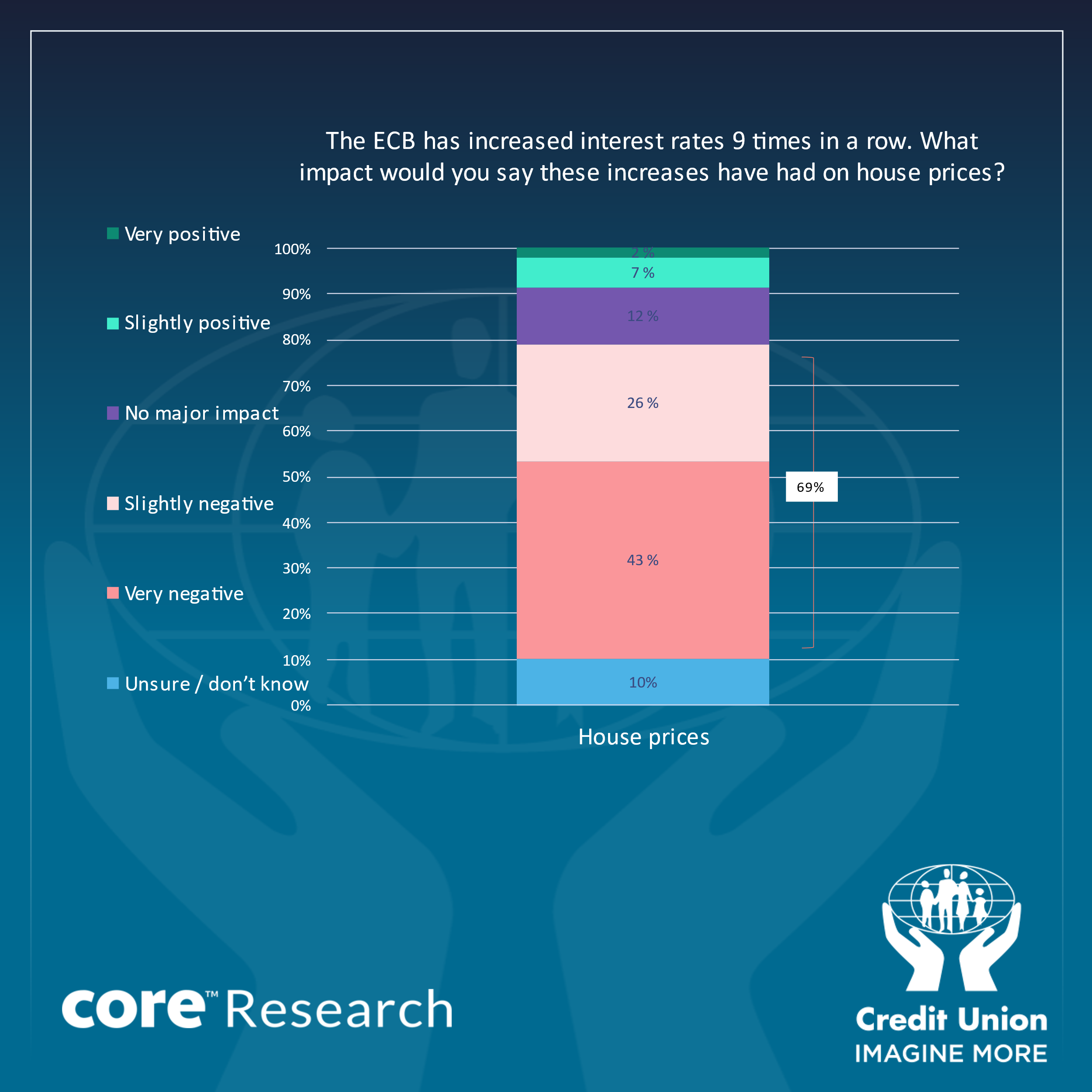

Higher rates expected to hit house prices

Finally, the August Credit Union Consumer Sentiment Survey (in partnership with Core Research) asked what impact higher rates might have on Irish house prices. As the table below indicates, 7 out of 10 Irish consumers (69%) think there will be a negative effect on Irish house prices. This result appears consistent with the clearly softer trend in Irish house price inflation seen through the past year. Reduced borrowing capacity and the weakening in the economic outlook can be expected to weigh on housing demand.

At the margin, higher borrowing costs could also weigh on the viability of some new housing supply. This could be an element in some of the 9% of responses citing a positive impact. We should also recognise the possibility that some prospective house-buyers might see the prospect of lower house prices as ‘positive’ for them personally and may have framed their responses to this question in that light.

Special questions focus on impact of ECB interest rate hikes

-

3 out of 4 consumers see negative impact on Irish economy

-

2 out of 3 see negative impact on their personal finances, with half of these seeing ‘very negative’ effect

-

7 out of 10 see negative impact on house prices

-

4 out of 5 Irish consumers see ECB rate hikes hurting rather than helping in terms of cost of living pressures