December 2023 Consumer Sentiment Index | Published: 21/12/23

December sentiment survey suggests Irish consumers see a little more light but feel they are not out of the tunnel

Analysis by Austin Hughes. Contact 0876696972.

- Irish consumer sentiment increased fractionally in December signalling further slight easing in cost-of-living pressures

- Notable divergence between renewed ‘macro’ concerns and less negative thinking on household finances

- Consumers likely responding to falling energy prices and expectations of lower inflation and interest rates in coming year

- Caution still the prevailing mood as consumer sentiment index remains well below long term average

- Christmas fear may be fading but Christmas cheer is still limited. The survey's direction of travel is encouraging but the destination of a confident and financially comfortable Irish consumer is still some distance away

- Special Question examines Irish consumers ‘Santa list’ of their 3 key priorities for 2024

- 76% of consumers see cost-of-living as key area where improvement is needed

- 43% cite healthcare as a key priority area while 38% cite housing supply

Speaking on the release of the October data and analysis, David Malone, CEO of the Irish League of Credit Unions noted; “The small but continuing pickup in Irish consumer sentiment is encouraging and hopefully suggests that 2024 will be a year of improving conditions for Irish households. Whatever opportunities and challenges await, Irish consumers can be confident of the support of their local credit union”.

Summary

Irish consumer sentiment edged marginally higher in December, hinting at a still tentative easing in cost-of-living pressures and a little less worry about the outlook for household finances. In turn, this prompted a modest improvement in spending plans.

Overall, Irish consumers remain concerned about their financial circumstances and cautious in their thinking about the year ahead, but they are notably less negative and fearful than they were twelve months ago.

In broad terms, the December 2023 reading might be described as signalling an easing in Christmas fear rather than overwhelming Christmas cheer.

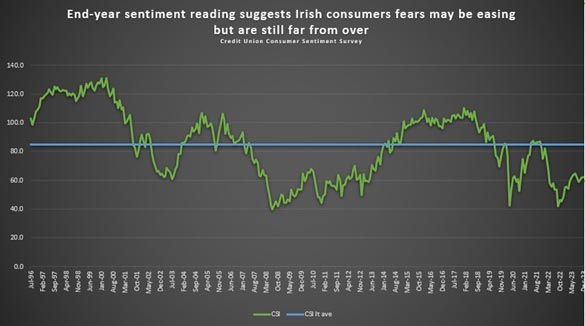

Some sense of a possibly emerging turnaround in confidence is suggested by the fact that the December 2023 sentiment reading is clearly higher than that of December 2022.

This is the first year on year improvement in the December sentiment survey results since 2017 and, as well as underlining the range of challenges Irish consumers have faced in recent years, may hint that they feel 2024 could be a year where things feel slightly better.

Section 1; Slightly better December Sentiment suggests modestly improving trend is being sustained

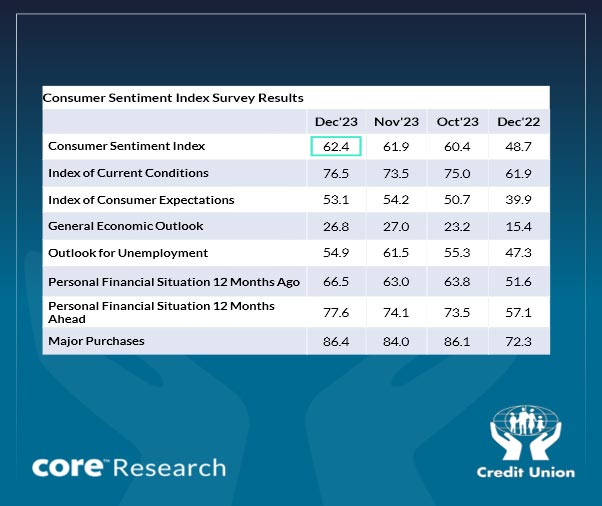

The Credit Union Consumer Sentiment Survey (in partnership with Core Research) rose fractionally in December, essentially signalling no major change in consumer thinking but sustaining the modest trend improvement in Irish consumer confidence that is suggested by successive gains through each of the past three months.

While the recent uptick in sentiment seems consistent with a slight easing in cost-of-living pressures of late, it should be emphasised that the general tone of the survey is still cautious.

As the diagram below illustrates, the December sentiment reading is still slightly below those seen in June and July and a good deal lower than the survey’s near 28-year average (of 84.7). As such, the December survey hints at an Irish consumer whose concerns are easing but far from over.

It is worth noting that the improvement in Irish consumer sentiment in December was altogether more modest than that seen in the US where the preliminary reading of the University of Michigan measure rose from 61.3 to 69.4 (Note; whereas the trend in sentiment in the two countries is comparable, the level of the two sentiment indices is not directly comparable).

The sharp improvement in US sentiment is being attributed to a marked change in the inflation outlook. After some really downbeat readings, it seems there was a marked change in consumer thinking in the ‘States regarding inflation this month.

Our sense is that an easing in inflation worries has been and continues to be developing more gradually among Irish consumers, perhaps reflecting greater nervousness about winter heating bills here.

The pick-up in US consumer sentiment in December also reflected greater optimism about the outlook for business conditions whereas Irish consumers were a little more negative about the outlook for the Irish economy and employment.

With UK and German consumer confidence also ticking higher in December, the likelihood is the commonly felt influence of lower energy prices and slower inflation prompted an improvement in the mood of consumers around the globe of late.

In the case of Ireland, the marginal increase in the Credit Union Consumer Sentiment Survey (in partnership with Core Research) came about because three elements of the December reading showed month-on-month improvements in December while two showed declines (in contrast to the US and UK surveys where all key elements improved).

Both ‘Macro’ elements of the Credit Union Consumer Sentiment Index were weaker in December than November. The December survey period saw some downbeat forecasts for the global economy but there were also some notable domestic developments that may have weighed on Irish consumers.

The release of notably weak Irish GDP data for the third quarter all but guarantee that the Irish economy will suffer a recession this year at least in terms of the GDP metric. While the resilience of the sentiment survey (and consumer spending) of late suggests that the weakness in GDP is not signalling a marked economic downturn or causing alarm among Irish consumers.

That said, it is scarcely surprising that the December reading saw some mark-down of the outlook for the Irish economy, particularly in light of continuing high-profile concerns about aspects of multinational sector activity.

The December sentiment survey also saw a renewed weakening in Irish consumers thinking on the outlook for unemployment. While this element of the survey has been choppy of late, it has underperformed the survey’s other key elements. The broad messaging from the survey is that Irish consumers seem to fear a clear cooling in the jobs market in the year ahead.

One factor in these results may be ongoing concerns around Tech sector employment. Another is a clear increase in official data for unemployment, with the jobless rate climbing from 4.1% in the Spring to 4.8% in November, entailing a 20k rise in numbers unemployed.

A further influence could be a small number of high-profile redundancy announcements that occurred during the December survey period varying from the Tech sector to jobs in hospitality and the dairy industry.

Although both ‘macro’ elements’ of the sentiment survey weakened somewhat in December this was more than offset by gains in the three elements of the survey focussed on household finances.

This divergence emphasises the contrasting influences on Irish consumer sentiment and spending power at present. The mixed elements and modest change in the sentiment survey also suggests no single factor is entirely dominating consumer thinking at present.

Our sense is that the improvement in the household finances elements of the consumer sentiment survey largely reflects some encouraging developments regarding cost-of-living pressures. European Commission data suggest that Irish retail prices for motor fuel and heating oil have continued to edge lower of late while several electricity and gas providers announced further cuts in their tariffs.

At the same time, November inflation data showed not just a sharp drop in inflation, but a month-on-month fall in Irish consumer prices. The fall was principally but not entirely driven by lower energy costs.

A final consideration is that while nobody expected the ECB to cut its key interest rates at its December policy meeting, expectations that borrowing costs could fall early and often in 2024 have increased markedly of late.

The easing in costs pressures of late stands in stark contrast to the circumstances of a year ago when inflation, in general, and energy costs, in particular, were on a worrying accelerating trend.

The general picture now emerging of a marked slowdown and partial reversal of cost increases was reflected in a broadly similar upgrade in the December survey in terms of consumer thinking both in regard to how their household finances had evolved in the past twelve months and how they might develop in the year ahead.

Although spending plans also improved in December, the increase in this area was more modest than that seen in other elements related to household finances.

This emphasises that the mood of Irish consumers remains very cautious, but it also reflects the fact that while there was an improvement in these elements of the survey in December, negative responses continue to materially outweigh positive responses for all three elements focussed on household finances and spending plans.

While pressures on household finances may be easing, the sentiment survey is very clear that cost of living pressures are far from over. As a result, Irish consumers remain careful in their thinking and in their spending at present.

Section II; What do Irish consumers want most (from Santa?) for 2024?

Given seasonal considerations, the special question asked as part of the December Credit Union Consumer Sentiment Survey (in partnership with Core research) took on a Christmas flavour. In effect, we asked Irish consumers what economic or financial present, they would most like ‘Santa’ to deliver in the year ahead.

Because most Irish consumers have been nice rather than naughty, we allowed them to choose three items from the relatively long list set out below. Because not all consumers believe in the magic of Christmas, we also asked what three items from the same list they thought were least likely to be delivered in 2024.

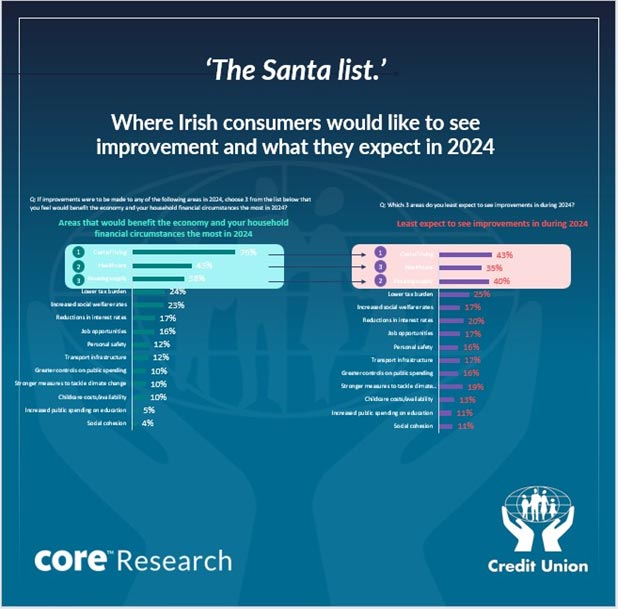

The responses to our ‘Santa list’ request are set out in the table below.

Just as there tends to be one ‘must have’ toy at Christmas, Irish consumers have strong and significantly shared views in terms of the priority for the economy in the year ahead. 76% of consumers see the cost-of-living as a key issue to be addressed.

However, a substantial 43% don’t think an improvement in the cost-of-living is likely. While this suggests that the majority of consumers do envisage an improvement, this response largely chimes with the general air of caution on the part of Irish consumers at present.

Although a focus on cost-of-living concerns is very broadly based, at the margin, consumers outside Dublin, those reporting difficulty making ends meet, females and those aged 35 to 44 were both more likely to cite cost-of-living concerns as a priority and less optimistic that this issue will improve in the year ahead than other groups.

There was a sharp stepdown from cost-of-living concerns to other key priorities for Irish consumers. Perhaps surprisingly in terms of recent media focus, healthcare was the second most commonly cited priority for improvement for Irish consumers.

In this instance, the proportion of consumers who don’t see an improvement in healthcare next year was not too far below those indicating this as a priority issue. This likely reflects an understandable pessimism about long term difficulties in this area.

A focus on health was somewhat more prevalent among women, rose progressively with age but only up to 65 and was less prevalent among those reporting difficulty making ends meet, possibly reflecting a very basic hierarchy of needs among the latter.

Not surprisingly, an improvement in housing was cited prominently as a key priority for 2024 by a significant 38% of consumers. However, a slightly larger 40% of consumers don’t envisage an improvement in housing supply in 2024. Here too, this likely reflects a view that a longstanding problem is unlikely to move markedly closer to resolution in 2024.

It is entirely predictable that concern about housing is more common among those aged 25 to 34. It is also more prevalent among males than females but there were no marked differences among income groups, likely reflecting the universal nature of housing difficulties.

In terms of priorities for 2024, there was a further marked stepdown in terms of the proportion of consumers citing either a reduced tax burden or an increase in social welfare rates as a priority with expectations of improvements in these areas reasonably widely based.

Most other areas were only seen as priorities by notably smaller numbers of Irish consumers and, while slightly larger numbers felt there would not be improvements in these ‘secondary’ areas, the broader message is that survey responses would imply most consumers expect improvements across a broad sweep of areas in 2024.

In that context, it might seem that with the exception of longstanding and vexed problem issues, Irish consumers think the year ahead is likely to see improvements across a range of areas that if realised might suggest 2024 will be on the comparatively nice rather than nasty list for Irish consumers.

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The December survey was live between the 4th and 15th December 2023.