October 2023 Consumer Sentiment Index | Published: 31/10/23

Budget boosts consumer sentiment but nervousness still prevails

- October sees partial reversal of recent weakening in sentiment

- Irish confidence boost contrasts with gloomier readings elsewhere

- Budget support measures likely driver of easing in consumer concerns

- Household finances and spending plans see gains…

- …But outlook for jobs weakens, signalling a cooling in jobs market?

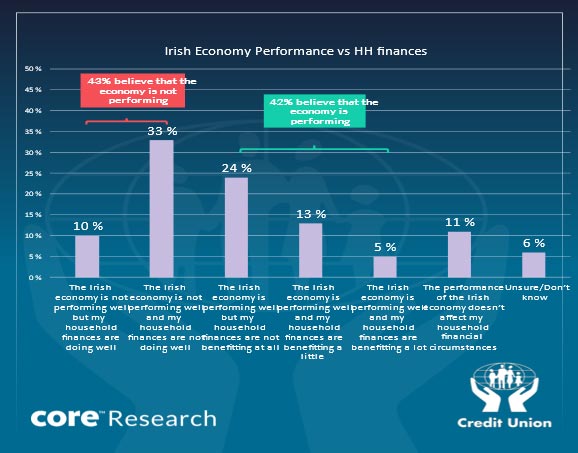

- Special question asks consumers how well Irish economy is performing at present and how much that affects them:

- A multi speed-economy; thinking on Irish economy varies widely with equal numbers of positive and negative views

- Consumers feel disconnected from ‘macro’ gains: Twice as many consumers say they are not doing well or not benefitting as those who say they are benefitting or doing well

- Negativity likely reflects scale of cost-of-living pressures

Speaking on the release of the October data and analysis, David Malone, CEO of the Irish League of Credit Unions noted; "The improvement in the Credit Union Consumer Sentiment Survey in October is encouraging in that it suggests that with the right supports Irish consumers may be better able to make their way through what are very challenging times financially".

Summary analysis

Irish consumer sentiment improved modestly in October as Budget support measures made consumers a little less gloomy about their household finances. This uptick seems to be driven by domestic factors as improved sentiment in Ireland contrasts markedly with weaker results in the latest readings for similar confidence measures for the US, Germany and the UK.

The broad tone of Irish consumer sentiment remains cautious, as cost-of-living concerns remain elevated and nervousness about the outlook for jobs has increased. However, Budget ’24 measures seem to have encouraged some improvement in household spending plans in October.

Section I; Budget measures provide some comfort to consumers but caution still prevails

The Credit Union Consumer Sentiment Survey (in partnership with Core Research) for October increased to 60.4 in October from 58.8 in September. This still suggests an Irish consumer who is nervous and facing significant financial pressures. The 1.6-point monthly gain in October reversed just under half the 3.4-point fall seen between August and September and leaves Irish consumer sentiment clearly below the 15-month high of 64.5 recorded in July and some considerable distance below the 27-year survey average of 84.9.

Global gloom around living costs hitting consumer confidence elsewhere

The improvement in the Credit Union Consumer Sentiment Index for October should be seen against a backdrop of sliding sentiment in a range of other countries of late. In the US, the University of Michigan Measure posted an unexpectedly sharp decline which was attributed to increased cost-of-living concerns.

Commenting on a similarly notable drop in UK consumer confidence, GFK, who prepare that report, noted that ‘This sharp fall underlines that the cost-of-living crisis, and simply not having enough money to make-ends-meet, are still exerting acute pressure for many consumers.’ In the same vein, the third monthly fall in a row in German consumer confidence was seen as a reflection of the financial difficulties posed by high energy and food prices.

Sentiment survey hints that at somewhat cooler jobs market amid mixed macro signals

Four of the five key elements of the Credit Union Consumer Sentiment Survey for Ireland posted monthly gains between September and October. The exception was consumer thinking on the outlook for jobs which weakened to its lowest level in 7 months. The vast bulk of survey responses were completed before the announcement of the planned closure of the Wyeth plant in Limerick with the expected loss of 540 jobs.

The survey period saw a marginal rise in the unemployment rate (from 4.1% in August to 4.2% in September) and a more pronounced rise in unemployment among those aged under 25 (from 11.4% in August to 11.9% in September). Interestingly, the change in thinking on unemployment in the sentiment survey was most pronounced in those aged under 25.

At the margin, this may be consistent with a notably slower monthly pace of job gains of late in the CSO’s monthly estimates of payroll employees. While commentary has tended to focus primarily on a shortage of employees, upcoming sentiment surveys and under 25 jobless data may bear watching as they could point to some cooling in demand for new hires.

Notwithstanding increased concerns around the jobs market, consumer thinking on the broader economic outlook changed little in October. Although the latest ESRI forecasts spoke of a technical recession this year, the growth outlook for 2024 remained robust. In the same vein, the survey period saw the Economist magazine ran a feature ranking Ireland as ‘the clear winner among European economies’ and the latest IMF forecasts were similarly positive in contrast to some high profile domestic criticism of the ‘macro‘ implications of Budget’24.

Budget measures support sentiment and spending plans

The improvement in the Credit Union Consumer Sentiment Survey for October was concentrated in those elements focussed on household finances. As noted above, more negative views on household finances weighed on sentiment readings in other countries of late. With the inflation rate rising further, albeit marginally, through the survey period, the improvement in this element of the survey is likely attributable to a positive assessment of the various support measures introduced in Budget ’24. Post-Budget ESRI analysis suggested Budget measures would boost Irish consumers’ real spending power in the year ahead.

In contrast to widely aired critical commentary around continuing Budget ‘giveaways’, the ESRI analysis also noted that, over the past four years, Budget measures amounted to less than indexation. Partly reflecting this squeeze on spending power, as well as broader marked cost-of-living difficulties, it remains the case that despite the improvement in October, the balance of responses in relation to household finances in the Credit Union Consumer Sentiment Survey remains firmly negative.

As there appears to be a debate in some circles as to whether cost-of-living pressures are exaggerated, it may be worthwhile considering the CSO data to assess whether the negative sentiment reading on household finances is supported by the official statistics. The acceleration in consumer prices in Ireland and elsewhere began in Spring 2021 (Irish inflation was negative up to February of that year).

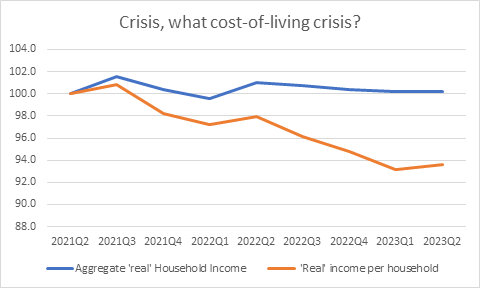

The latest CSO data show that aggregate household incomes were 0.2% higher in Q2 2023 than in Q2 2021. As the population increased by 4.1% through this period, this implies that the average Irish person is about 4% worse off than 2 years ago. When account is taken of a somewhat faster increase in the number of households (that would have separate more expensive household bills), the drop in average living standards is around 6%, as the diagram below illustrates. So, official data suggest that current sentiment readings are consistent with the experience of the average Irish consumer through the past couple of years.

Encouragingly, a modest easing in concerns in relation to their household finances coincided with an improvement in consumer spending plans. Again, it should be noted that the October reading points to considerable caution in relation to the buying climate at present. However, it may be that Budget measures have made more consumers both able and willing to spend.

Section II Boom or gloom for the Irish economy and do consumers think that it matters for them?

Although recent developments such as the pandemic and the Russian invasion of Ukraine have had significant consequences for most households and businesses, and the ‘average Irish consumer is worse of than two years ago, it remains the case that economic and financial circumstances appear to vary widely across the range of Irish consumers.

For example, substantial discretionary spending power may be inferred from predominantly Irish crowds for all the country’s recent rugby world cup matches while widely based financial distress is suggested by recent data indicating that as many as 256,000 or 12% of domestic customers were in arrears on their electricity bills in June 2023.

In addition, consumer thinking on ‘macro’ developments is clouded by a multi-speed Irish economy. In this context, the October survey period saw the ESRI warn of a technical recession alongside the risk of overheating. A sense that the current position of the Irish economy is quite unclear is evident from the latest retail sales data that show sales volumes (excluding the volatile cars sector) down 2% in the 3rd quarter of 2023 from the previous quarter and up 1.1% on a year earlier while the ‘flash’ GDP estimate for the 3rd quarter was down 1.8% on the previous quarter and 4.7% below the level of a year earlier.

In this context, the October Credit Union Consumer Sentiment Survey (in partnership with Core Research) asked a supplementary question intended to assess how ‘connected’ consumers felt their circumstances were to the ‘macro’ environment and how strong they felt that environment to be at present. (It should be noted that this special question on the performance of the Irish economy is notable different in tone and in respect to timeframe than the standard question on the economic outlook asked each month).

The responses shown in the table below highlight notably differing circumstances and connectivity to the ‘macro’ environment across Irish consumers.

Perhaps surprisingly, the most common answer, given by 1 in 3 consumers (33%) was that neither the Irish economy nor their own finances were doing well. This may reflect consumers judgement that economic performance is best measured by a palpable sense of rising real incomes (which has been absent in the past couple of years) rather than widely used technical metrics such as Gross Domestic Product (GDP), or particularly Irish variants such as Modified Gross National Income (GNI*) OR Modified Domestic Demand.

Demographic differences in responses were not dramatic but there were some clear variations. This response was more prevalent among consumers aged under 45, among females, among those with fewer education qualifications, among those based in Munster and, not surprisingly, among those reporting difficulties making ends meet. It could be that this partly reflects some continuing post-Covid ‘scarring’ and/or cost-of-living impacts in some areas that are affecting income and job prospects and informing consumer thinking on the performance of the economy relevant to them.

The second most common response, given by 1 in 4 consumers (24%), was that while they felt the Irish economy was doing well, their personal financial circumstances didn’t reflect that. This response was more prevalent among those over 55, among men and among those citing difficulties in making ends meet.

Just under 1 in 5 consumers (13%+5%) judge the Irish economy to be doing well and say they are benefitting either a lot or a little. These responses tended to be a little more common among Dublin-based consumers, among males, among those aged over 65, among those with the strongest educational qualifications, higher income consumers and those indicating they were comfortably making ends meet.

A further 1 in 10 consumers (10%) say the economy is not doing well but they are. These responses tended to be more common among Dublin-based consumers, among those aged under 25, among those with the strongest educational qualifications and high-income households.

From a consumer perspective, it seems both that the temperature varies significantly across the Irish economy and that household finances are affected by or insulated from economic conditions to notably different degrees. In a sense, the results only confirm a widely held view of Ireland as a multi-speed economy but at a time when most economic commentary is focussed on issues around overheating, as many consumers say the economy is running cold (10%+33%) as say it is performing well (5%+13%+24%).

In the same vein, twice as many consumers (24%+33%) say their household finances are not doing well or not benefitting as those who say they are benefitting or doing well (5+13%+10%). In that light, it seems that the ‘trickledown’ of stronger elements of Irish economic performance are felt far less by consumers than the financial turmoil from Covid and cost-of-living pressures.

The Credit Union Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the survey. The October survey was live between the 4th and 18th October 2023.