December 2022 Consumer Sentiment Index | Published: 21/12/2022

Improved sentiment reading suggests Christmas bringing some relief to Irish consumers

- Irish consumer confidence increases for second time in past three months

- Wide range of factors may have driven slight easing in concerns

- Sentiment index pointing to a nervous but not completely negative Irish consumer

- Special question suggests cost of living pressures seen as key negative for 2023 alongside global uncertainty but housing and climate change also troubling the majority of consumers. Most consumers see Government support as a key positive

Section I; Consumers slightly less concerned but still cautious in December

Irish consumer sentiment improved to its best level since August this month. Encouraging economic news, a fuel price-led easing in inflation, reduced job concerns and Government support measures may have combined with a measure of seasonal positivity to boost the mood of hard-pressed households. The modest rise in consumer confidence suggests caution still prevails but sentiment and spending have not been derailed completely by a very difficult 2022.

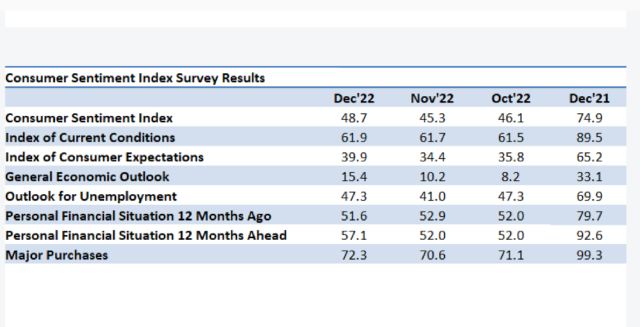

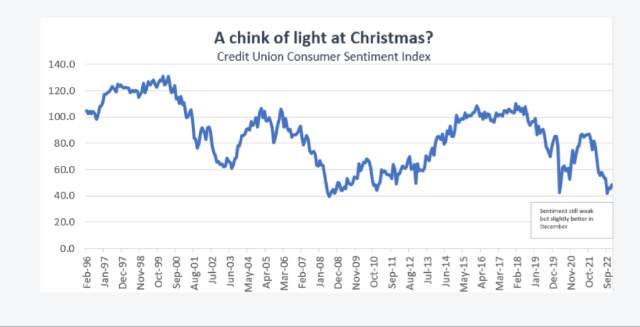

The Credit Union Consumer Sentiment Index increased to 48.7 in December from 45.3 in November. This marks the second improvement in the past three months and, as there were only four increases in the past twelve months, it tentatively suggests that consumers now feel they have prepared themselves in so far as possible for very challenging economic and financial conditions. In the same vein, as the diagram below illustrates, while the December reading may be low by the historic experience of the survey, it is at its best level since August when the threat of very expensive light and heating this winter began to loom large.

The improvement in sentiment was broadly based as the table at the top of this note shows but the largest improvement in the December reading was in the two ‘macro’ elements. A significant upgrade in consumer thinking on the general economic outlook likely reflected the release of relatively positive data showing low unemployment, slowing consumer and property price inflation and buoyant tax revenues as well as strong economic growth.

In addition, several reports eased fears that Tech sector job loss announcements of the previous month might herald a more broadly based weakening of the jobs market. As a result, the significant weakening in the jobs element of the sentiment survey seen in November was fully reversed.

The resilience of the Irish economy -both in terms of activity and employment- in the face of very threatening global developments continues to confound commentators and consumers alike. As a result, adverse shocks such as those of the past year tend to see ‘macro’ expectations marked down severely in response to unfolding developments and upgraded only gradually thereafter.

Concerns have stopped building but they haven’t gone away. While December marks Irish consumers’ most positive assessment of the broad economic outlook since June, it remains the case that the overwhelming view is that the Irish economy will weaken in the next twelve months. In the same manner, the best reading for the jobs element of the survey since August still translates into a broadly based view that Irish unemployment will rise in 2023.

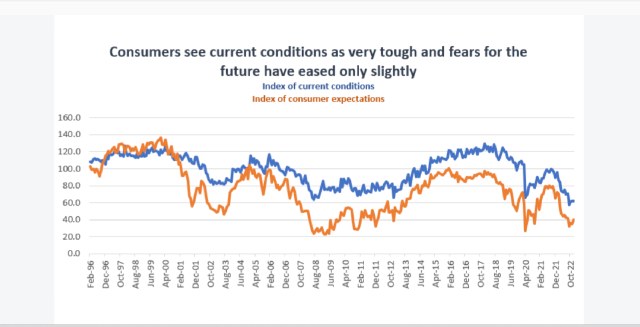

If the ‘macro’ elements of the survey reflect consumer thinking on issues beyond their everyday dealings, the other elements are grounded in their first-hand experience. The current conditions sub-index measures consumers assessments of how their household finances have evolved and whether it is now a good or bad time to make major purchases. As the diagram below illustrates, the November survey saw the weakest reading in current conditions in the twenty-six plus years of the survey. December saw only a marginal improvement suggesting most consumers are still experiencing significant financial pressures.

It should be emphasised that this does not means that the current conditions faced by Irish consumers are worse than those experienced during the financial crisis but it does suggest the substantial drop in spending power wreaked by the cost of living crisis has prompted a sharper and more negative change in the circumstances of more households in the past twelve months than was seen previously.

This result gives a strong sense of how embedded that cost of living pressures are at present. More households judged their circumstances had worsened in the past twelve months in December than in November and this was the one element of the survey to weaken in the latest reading.

One possible explanation for this is that colder weather and seasonal spending requirements highlighted the strain on household finances. While the official inflation rate eased in November, consumers may have been spending more of their money on notably more expensive essentials such as heating and food of late.

Although consumers were slightly more negative about the trend in their personal finances in December, their spending plans picked up modestly. So, although many were less able, they were more willing to spend. Part of this could be seasonal. Price discounting in ‘Black Friday’ type promotions may also have helped and the receipt of Government support coupled with a less negative outlook for the year ahead could also have played a role.

While we would highlight the survey evidence as pointing to the degree of difficulty facing Irish households at present, the marginal pick-up in spending plans and expectations for household finances through 2023 offer some small measure of encouragement in relation to the prospects for sentiment and consumer spending in 2023.

Section ll; What matters most at the minute to Irish consumers?

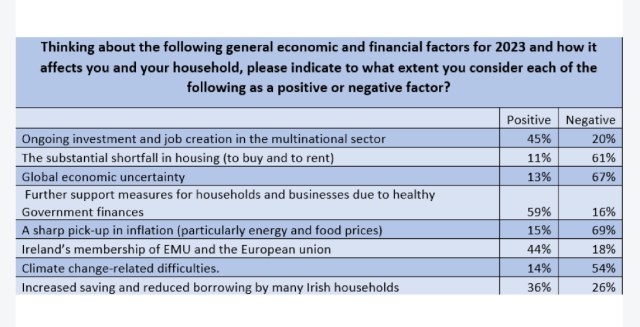

It may be interesting to get a sense of what factors, either good or bad, consumers think will be important to them in the coming year. As a supplementary question to the December Consumer Sentiment survey, we asked consumers to assess whether they judged various issues as likely to be positive or negative to their economic and financial circumstances in 2023. The table below summarises the results.

The responses to this question give some sense as to how broadly felt across the spectrum of Irish consumers various pressures and positives are at present. Interestingly, if perhaps surprisingly, no issue highlighted was regarded as universally positive or negative. In some instances, this may reflect different opinions. In others, different interpretations of the question. Finally, it may also reflect different positions. For example, someone with a house to sell or rent might regard the shortfall in supply as a positive.

Based on these responses, cost of living difficulties represents the most widely felt problem issue for the year ahead, cited by 69% of consumers. A broadly similar number (67% of consumers) see global economic uncertainty as a significant negative. Housing and climate change follow closely behind. Indeed, given the number of respondents not actively seeking accommodation at present, the proportion of consumers signalling concern about housing suggests how central this issue is to perceptions of economic performance. In the same vein, the majority view that climate change difficulties are of immediate importance is also striking.

Although a non-negligible 16% of consumers may view extensive fiscal supports as a matter of concern, a substantial 59% see Government support measures as an important positive influence on prospects for 2023. The 20% of consumers who see multinational sector activities as a negative likely include significant numbers who may be worried about excessive dependence on this sector, However, just under half of Irish consumers (45%) see ongoing multinational investment in Ireland as a favourable influence on the outlook for the year ahead.

In the same context, notably more consumers (44%) see Ireland’s membership of the EU and EMU cushioning exposures than view it as a constraint (18%). The comparatively divided thinking on increased household saving and reduced borrowing possibly unconsciously chimes with differences in economic thinking that tend to emphasise either prudence or ‘the paradox of thrift’. As a result, some see this changed behaviour making the Irish economy less vulnerable while others may see it as a drain on current activity and, possibly, a reflection of unequal circumstances.

The Irish Consumer Sentiment Survey is a monthly survey of a nationally representative sample of 1,000 adults. Since May 2019, Core Research have undertaken the survey administration and data collection for the Survey. The survey was live between the 1st-14th December 2022.